Introduction: What is Westpac Refinance?

Westpac Refinance loans are designed for homeowners looking to move their existing mortgage from another lender to Westpac. This process, commonly known as refinancing, allows borrowers to take advantage of new features, competitive rates, and potential cash incentives.

As one of Australia’s largest banks, Westpac provides multiple refinance options for different borrower profiles. Their products often include variable and fixed rate choices, offset accounts, and digital application tools.

The highlight for many customers is the Westpac refinance cashback offer, which provides a one-time cash incentive when switching to Westpac. While not the only feature, it has become one of the most talked-about aspects of their refinance packages.

This review explores the benefits, drawbacks, eligibility, and application process, with a neutral focus to help readers understand whether Westpac refinance options align with their needs.

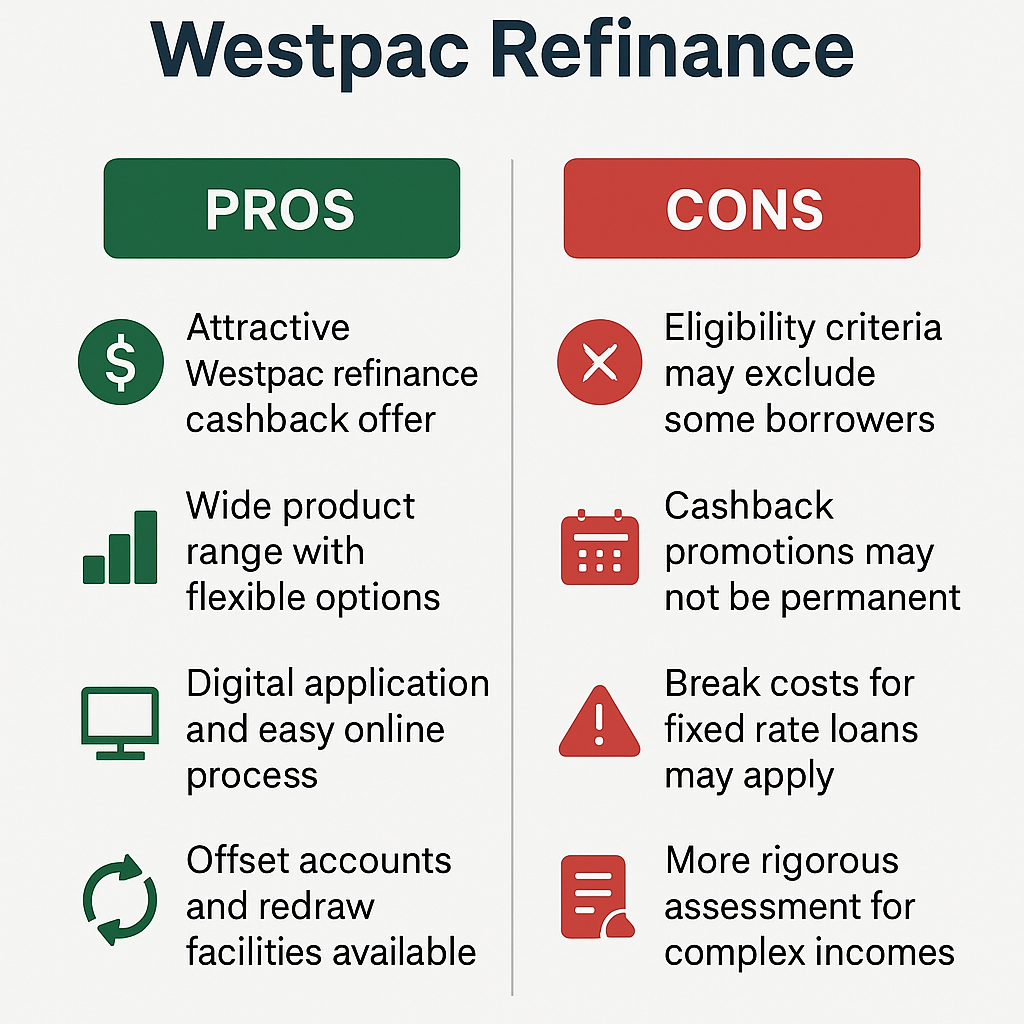

Benefits of Westpac Refinance

One of the primary benefits is the refinance home loan cash back that Westpac periodically offers. This incentive is designed to offset the costs of moving a loan, such as discharge fees or government charges.

Westpac also provides access to a wide range of features, including redraw facilities and offset accounts. These tools can help borrowers manage repayments more effectively and reduce long-term interest costs.

Another advantage is the ability to consolidate multiple debts into a single home loan refinance, simplifying repayments. For customers juggling different credit products, this can provide more control.

Finally, Westpac’s digital application process is considered user-friendly, allowing most borrowers to begin and track their refinance entirely online.

Drawbacks of Westpac Refinance

Despite its strengths, Westpac refinance home loans are not without limitations. The mortgage refinance cashback is often subject to strict eligibility criteria, such as minimum loan amounts and specific product types.

Another drawback is that cashback offers can change frequently, meaning borrowers cannot always rely on their long-term availability.

Westpac’s assessment process may also be more rigorous compared to smaller lenders, particularly for self-employed borrowers or those with non-standard income.

Finally, fees and break costs for fixed rate loans can apply if a borrower exits early. These costs should be carefully reviewed before committing.

Who Might Consider Westpac Refinance Home loans?

Westpac refinance may be relevant for homeowners with a moderate to high loan balance who are eligible for the refinance cashback offer. The minimum loan size requirements often make it better suited to those with larger mortgages.

Borrowers seeking a well-established lender with a broad range of support services may also find Westpac appealing. Its national presence provides reassurance for those who prefer dealing with a major bank.

Investors looking for features such as offset accounts, multiple loan splits, or flexible repayment options may benefit from Westpac’s refinance home loan structures.

However, it is important to note that not every borrower will qualify for the best refinance deals. Careful comparison is essential.

Application Process

Westpac allows borrowers to apply for refinance online, in-branch, or through a broker. The digital application process is popular for its convenience and speed.

Typically, borrowers will need to supply income verification documents, recent payslips, and details of existing liabilities. Identification documents are also required.

A preliminary assessment, sometimes referred to as pre-approval, helps confirm whether the borrower is likely to qualify before a full credit check and property valuation is conducted.

Once approved, Westpac manages the discharge process with the existing lender and transfers the loan. At this stage, eligible borrowers may receive the mortgage cash back payment.

For tailored guidance and to compare whether this is the right option, you can also speak to an OurTop10 specialist to discuss refinance options and gain clarity on the latest cashback deals and product features.

Additional Considerations

The home loan refinance cashback offered by Westpac has positioned it as one of the more competitive cashback providers in recent years. However, it is not always the highest in the market.

Borrowers should be aware that the best cash back home loans are not always the best fit overall. Interest rates, fees, and loan flexibility should be weighed equally against any upfront cash incentive.

The eligibility criteria for cashback deals often require that the loan remains with Westpac for a minimum period. Exiting earlier may result in the loss of the benefit.

Conclusion

Westpac refinance provides a mix of incentives and features that appeal to a broad range of borrowers. The Westpac refinance cashback is a strong drawcard, but it is not the only factor to consider.

The combination of flexible loan structures, a large support network, and digital tools makes Westpac refinance a practical choice for those seeking stability from a major bank.

However, borrowers should remain aware of potential fees, strict eligibility rules, and changing cashback promotions. Comparing multiple refinance offers ensures the product aligns with both immediate and long-term needs.

In summary, Westpac refinance is a significant option in the Australian market, but careful evaluation of both benefits and drawbacks is essential.

FAQs

- What is the Westpac refinance cashback offer?

The Westpac refinance cashback offer is a promotional incentive where eligible borrowers receive a lump-sum payment when refinancing their home loan to Westpac. - Who is eligible for Westpac refinance cashback?

Eligibility usually depends on meeting minimum loan amounts, refinancing from another lender, and choosing specific loan products. Terms may change over time. - How long does the Westpac refinance application take?

The process varies, but digital applications can often be assessed within a few days. Full approval, including property valuation, may take longer. - Does Westpac refinance suit investors?

Yes, Westpac refinance products include options for investment loans, offset accounts, and multiple splits, which may be useful for property investors. - Are Westpac refinance cashback offers permanent?

No, cashback offers are time-limited promotions. Westpac may change or withdraw them at any time, so borrowers should check the latest terms before applying.