Introduction

For many Australians, saving a 20% deposit to buy a property can feel almost impossible. With rising property prices, that 20% benchmark often means saving hundreds of thousands of dollars, including various insurance costs .

Traditionally, borrowers without a 20% deposit must pay Lenders Mortgage Insurance (LMI), but with an lmi waiver, they could avoid this cost. This makes home ownership even further out of reach for many buyers.

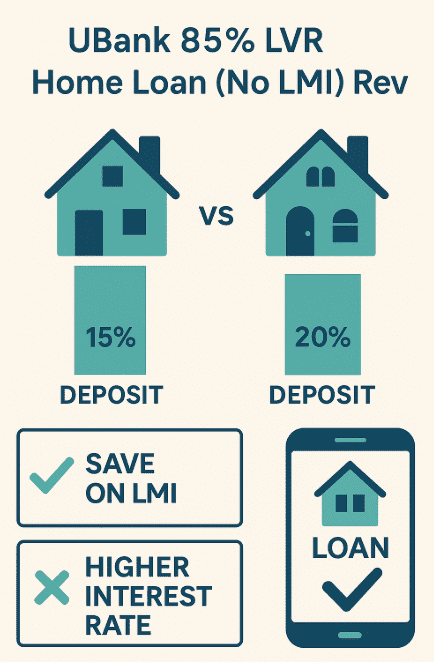

UBank has introduced a competitive alternative with its 85% LVR no-LMI home loan. This allows eligible borrowers to purchase with just a 15% deposit, while still avoiding LMI, which many lenders offer .

What Is Lenders Mortgage Insurance and Why Is It Important?

LMI is an insurance premium charged by lenders when your deposit is under 20%. It protects the lender, not the borrower, in case of default.

Eg: on a $600,000 home loan, LMI might cost anywhere from $5,000 to $15,000. This is money you don’t get back and cannot add to your equity.

Avoiding LMI means borrowers entering the market sooner and keeping more money in their pockets to save money for other expenses . This is where UBank’s product stands out.

Key Features of UBank’s 85% LVR Home Loan

The UBank product offers several standout features:

- Borrow up to 85% of the property value without paying LMI.

- Variable rates from around 5.99% p.a., with comparison rates between 6.01% and 6.23%.

- Options include Neat Variable, Flex Variable, and selected fixed terms.

- The application is 100% online, with progress tracked via UBank’s App Tracker.

- Backed by National Australia Bank, providing borrowers with financial stability and trust.

Who Should Consider This Loan?

This home loan is best suited to buyers who have saved at least a 15% deposit, meeting the genuine savings required, but want to avoid paying LMI.

It appeals particularly to first home buyers who may not have had time to build up a full 20% deposit due to their personal financial situation .

How Much Could You Save?

Consider a property priced at $600,000.

- With a standard 80% home loan, you’d need a $120,000 deposit.

- With UBank’s 85% home loan, you only need a $90,000 deposit.

- With another lender at 85%, you may still need to pay LMI of $5,000–$10,000.

This means UBank saves you both deposit requirements and the additional cost of insurance.

Comparison With Traditional Lenders

Most traditional banks require borrowers above 80% LVR to pay LMI. This can significantly increase the cost of buying a home.

UBank offers a middle ground: a smaller deposit requirement without the LMI sting.

The trade-off is slightly higher interest rates, but many buyers see this as a worthwhile exchange.

Comparison With Home Loans That Offer Offset Accounts

Some low-LVR home loans with other lenders include offset accounts as standard.

UBank’s Neat product does not offer this feature, while the Flex product does, but at a higher comparison rate.

Borrowers must weigh whether they value the offset facility enough to pay the higher rate.

Application Process

UBank has streamlined its process into a digital-first journey.

Borrowers apply online, upload documents, and track their application in real time using the App Tracker.

Conditional approval can often be achieved in one to two days, making it faster than many traditional lenders.

Risks to Consider

The main risk is the higher repayments compared to 80% LVR loans, especially considering the loan to value ratio . Over the life of the loan, this difference adds up.

Borrowers must also be comfortable dealing entirely online. Those who want face-to-face interaction may find this limiting.

Finally, because the loan is capped at 85% LVR, buyers with smaller deposits will not qualify.

Case Study Example

Sarah and Tom want to buy a $700,000 property. They have saved $105,000, which is a 15% deposit.

If they went with a traditional bank, they would need to pay around $12,000 in LMI.

By choosing UBank’s 85% no-LMI loan, they avoid that cost and can enter the property market without delay.

Expert Tips

Always compare the comparison rate, not just the advertised rate, to understand the true cost.

If your property value rises or your deposit grows, consider refinancing later to access sharper interest rates.

Also, factor in whether you need an offset account or redraw facilities, as this could affect which loan option is right for you.

Alternatives to Consider

If you don’t qualify for UBank’s 85% product, other options include:

- Saving longer to reach 20% deposit.

- Applying for the First Home Guarantee scheme through a major lender.

- Exploring shared equity or family guarantee options.

Each comes with its own pros and cons, but UBank provides a strong alternative without needing government intervention.

Conclusion

UBank’s 85% LVR no-LMI home loan is a standout product for Australians looking to buy with less than a 20% deposit, similar to some flex home loans .

It allows eligible borrowers to save on upfront costs, avoid LMI, and take advantage of a fast digital application process.

While the trade-off is a higher interest rate, for many this is a worthwhile compromise to enter the property market sooner.

FAQs

- Does UBank really allow 85% borrowing with no LMI?

Yes. Eligible owner-occupiers can borrow up to 85% without paying Lenders Mortgage Insurance. - What interest rates apply?

Rates start from 5.99% p.a., with comparison rates between 6.01%–6.23%. - Can investors use this loan?

No. It is only available for owner-occupiers on principal & interest repayments. - Does the loan include offset accounts?

The Flex Variable option includes offset, while the Neat Variable does not - How fast is approval?

Conditional approval is often achieved within one to two business days.

Connect with a mortgage broker here to discuss your scenario.