Introduction

The St.George Advantage Package is one of the bank’s most popular home loan offerings, designed to provide customers with bundled benefits across loans, credit cards, and transaction accounts. By combining multiple financial products, borrowers may gain access to fee savings and competitive interest rates.

This package is commonly considered by borrowers seeking long-term financial management solutions, whether for first-home purchases, investment loans, or refinancing. With additional features like credit card fee waivers and insurance discounts, the package aims to deliver value beyond the home loan itself.

Key Features of the St.George Advantage Package

At its core, the St.George Advantage Package combines a home loan with other financial services, offering fee discounts and benefits in exchange for an annual package fee. Borrowers may access both variable and fixed rate options, along with principal and interest or interest-only repayment types depending on eligibility.

The package typically includes features such as offset accounts, redraw facilities, and reduced fees on linked accounts. Credit card annual fees may be waived when linked to the package, and home insurance premiums may come with discounts.

Loan-to-value ratios (LVR) of up to 95% may be available, although borrowing above 80% usually requires lenders mortgage insurance (LMI). Eligibility is based on income, credit history, and meeting St.George’s standard lending requirements.

Benefits of the St.George Advantage Package

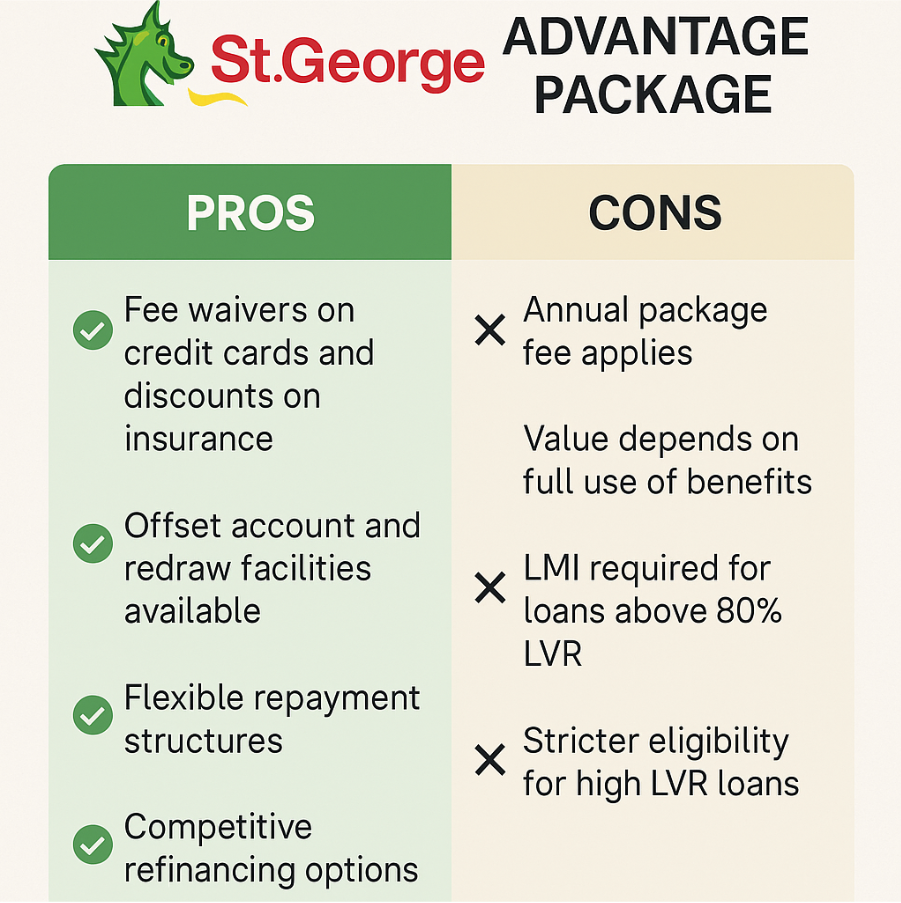

One of the biggest advantages of the package is the potential for long-term savings. Fee waivers on credit cards, discounts on home and contents insurance, and reduced loan fees can offset the annual package cost.

Another benefit is flexibility. Borrowers can choose from a range of home loan products under the package, tailoring repayment structures and loan types to suit their financial goals.

The St.George refinance option under the Advantage Package is also attractive to borrowers switching from another lender, as it may provide access to competitive rates and package benefits.

Drawbacks of the St.George Advantage Package

The main drawback is the annual package fee, which may not deliver value if borrowers do not use all the included benefits. For those with smaller loan amounts, the cost savings may not outweigh the fee.

Additionally, the St.George Advantage Package may come with stricter eligibility requirements, particularly for high LVR loans. Borrowers seeking greater flexibility on niche loan structures may find other lenders more accommodating.

Another consideration is that while the package offers broad benefits, not all customers will need every included feature, which could make the package less cost-effective.

Comparison to Alternatives

Compared to standalone home loans, the St.George Advantage Package offers additional value through bundled benefits. This can be useful for customers who want banking products consolidated under one lender.

When compared to similar packages from other major banks, the St.George option is competitive, particularly in areas like offset accounts and linked product benefits. However, the annual package fee is relatively standard across lenders, so the overall value depends on individual borrower needs.

For borrowers considering St.George refinancing, the Advantage Package sits within a competitive landscape where lenders often use refinancing incentives and cashback offers to attract customers.

Who Might Consider This Product?

The St.George Advantage Package may be suitable for a wide range of borrowers, including first-home buyers, refinancers, and investors. First-home buyers may find value in the flexibility of repayment structures and access to offset accounts.

Investors may benefit from interest-only options, while refinancers could find competitive rates and long-term savings through package benefits. However, the suitability of the package depends on how much value borrowers place on bundled financial services.

Application Process

Applying for the St.George Advantage Package can be done online, in-branch, or with the help of a mortgage broker. The process generally begins with an application form, followed by the submission of personal details, proof of income, and identification documents.

St.George also offers pre-approval, which gives borrowers an indication of how much they may be able to borrow before committing to a property purchase. This can be particularly useful for those considering St.George refinance options.

Throughout the process, digital application tools and loan calculators are available. Speak to one of our team at OurTop10 for guidance on the application process and to explore your refinancing or purchase options.

Conclusion

The St.George Advantage Package is designed to offer borrowers long-term value by combining a home loan with additional financial benefits. For customers who use multiple St.George products, the package can provide fee savings and added convenience.

However, the package fee, eligibility criteria, and reliance on bundled benefits mean it may not be the best option for every borrower. This review highlights that the St.George Advantage Package is best understood as a holistic financial solution rather than just a home loan.

FAQs

- What is the annual fee for the St.George Advantage Package?

The package charges an annual fee, which covers fee waivers and discounts across linked products. - Can I refinance with the St.George Advantage Package?

Yes, St.George refinance options are available under the package, allowing borrowers to switch loans and access benefits. - Does the package include offset accounts?

Yes, eligible home loans within the package can include an offset account to help reduce interest payable. - What documents are required for application?

Applicants typically need proof of income, identification, and details of existing financial commitments. - Is lenders mortgage insurance (LMI) required?

Yes, LMI applies if borrowing more than 80% of the property value.