Income annualisation is one of the most common and least understood parts of a home loan assessment. We see it every day with clients who earn overtime, commission, casual income or contract income or who have recently changed roles. It also comes up frequently for people paid irregularly or partway through the financial year.

In this guide, we’ll explain what income annualisation is and why it matters when applying for a home loan. You’ll learn how banks calculate annualised income, when they use it, how different income types are treated and how to use an annualised income calculator correctly so the numbers line up with lender expectations.

What is income annualisation?

Income annualisation is the process lenders use to convert part-year or irregular income into an estimated full-year figure.

Rather than relying on a single payslip or your most recent month of earnings, banks look at how much income you have earned so far and project it across a full 12-month period. This allows them to assess income that does not arrive evenly throughout the year.

When applying for a home loan, this method helps lenders assess whether income is likely to support ongoing repayments, which directly influences borrowing power and approval outcomes.

When lenders apply income annualisation

Banks do not use annualisation for every borrower. If you earn a fixed base salary and have been in the same role long term, lenders usually rely on your current payslip and employment contract.

Annualisation comes into play in scenarios when income is less straightforward.

Year-to-date income on payslips

When a payslip shows year-to-date income, lenders often annualise it instead of relying on a single pay period. This is especially common when the application is submitted partway through the financial year and a full income history is not yet available.

Irregular pay cycles

Borrowers paid fortnightly, four-weekly or on variable schedules are more likely to have their income annualised. These pay cycles make it harder for lenders to assess income using one payslip alone, so projecting earnings over a full year provides a clearer picture.

Changes in income or employment

Income annualisation is commonly used when a borrower has recently changed jobs, received a promotion or adjusted their working hours. In these cases, lenders want to understand whether the new income level is likely to continue over time.

Variable income components

Overtime, allowances, bonuses and commission are rarely assessed at face value. Lenders often annualise these income components to smooth out short-term fluctuations and reduce the impact of unusually strong or weak periods.

Casual, contract or self-employed work

Borrowers who earn income casually, on contract or through self-employment are frequently assessed using annualisation. When income has only been earned for part of the year, lenders project it forward and then apply additional checks to assess stability.

“Income annualisation is where a lot of borrowers get caught out. What you’ve earned so far isn’t always what a lender will use — banks project your income across a full year and then stress-test how consistent it really is. If you don’t understand how that projection works, your borrowing power can look very different to what you expect.”

— Mansour Soltani, Mortgage Broker

How income annualisation works

Income annualisation is actually a simple calculation:

Income earned so far ÷ number of days or pay periods worked × 12 months

However, lenders rarely stop there.

In practice, banks apply additional filters to manage risk and meet responsible lending requirements. This may include averaging income over a longer timeframe, excluding short-term spikes that are unlikely to repeat, applying shading to variable components or placing caps on certain income types altogether.

Adjustment type | What it means in practice | Why lenders apply it |

Averaging | Income is averaged over a longer period, such as 6, 12 or 24 months | To smooth out fluctuations and reduce reliance on recent spikes |

Shading | A percentage of variable income is reduced, often by 20 to 50% | To allow for income volatility and uncertainty |

Exclusion | Certain income components are excluded entirely | When income is irregular, one-off or not ongoing |

Capping | Income is limited to a maximum amount | To prevent unusually high short-term earnings from overstating capacity |

History requirements | Income is only included after a minimum timeframe | To confirm consistency and stability |

According to guidance from the Australian Prudential Regulation Authority (APRA) and major bank credit policies, conservative treatment of non-guaranteed income is a core risk control. Lenders are required to assess whether income is sustainable over the life of the loan, not just whether it has been earned recently.

How different incomes types are annualised

Different income streams are treated differently. Understanding these distinctions is essential to setting realistic borrowing power expectations.

Base salary

Base income is the simplest to assess. If you’re employed on a permanent full-time or part-time basis, lenders generally accept your current base salary once it is verified by payslips and an employment contract.

Annualisation may still apply if you started mid-year or recently received a pay rise. In those cases, banks often annualise the new rate but may request confirmation from your employer to ensure the income is ongoing.

Overtime income

Overtime is rarely included at 100 per cent.

Most lenders require a consistent history and will review overtime earned over six to 12 months rather than projecting a recent high period forward. Even when overtime feels reliable, banks commonly reduce the final figure to account for variability.

Bonuses and commission

Bonuses and commissions are assessed conservatively. Lenders usually want to see a minimum history of six to 24 months and will often average earnings across multiple years.

One-off bonuses are commonly excluded, and even when income is trending upward, some lenders will rely on the lower historical average rather than the most recent figure. This creates one of the largest gaps between what borrowers earn and what banks assess.

Casual and contract income

Casual and contract income can be annualised, but evidence is critical.

Lenders typically look for consistent income over at least six to 12 months, regular hours or contracts and continuity within the same industry. Where hours fluctuate significantly, banks often rely on averaging rather than projecting the latest payslip.

Some lenders will not annualise casual income at all until a minimum timeframe has been met.

Self-employed income

Self-employed income is rarely annualised from payslips alone. Most lenders rely primarily on tax returns, notices of assessment and business financials.

Year-to-date figures may be considered in limited cases, but they’re usually heavily adjusted and used alongside historical income.

Using annualised income calculators correctly

An annualised income calculator provides a starting point for estimating borrowing capacity. While it doesn’t reflect a lender’s final decision when granting a loan, it’s a useful tool for early planning and setting realistic expectations.

To get the most accurate result, the information entered must reflect what lenders actually assess.

What figures to enter

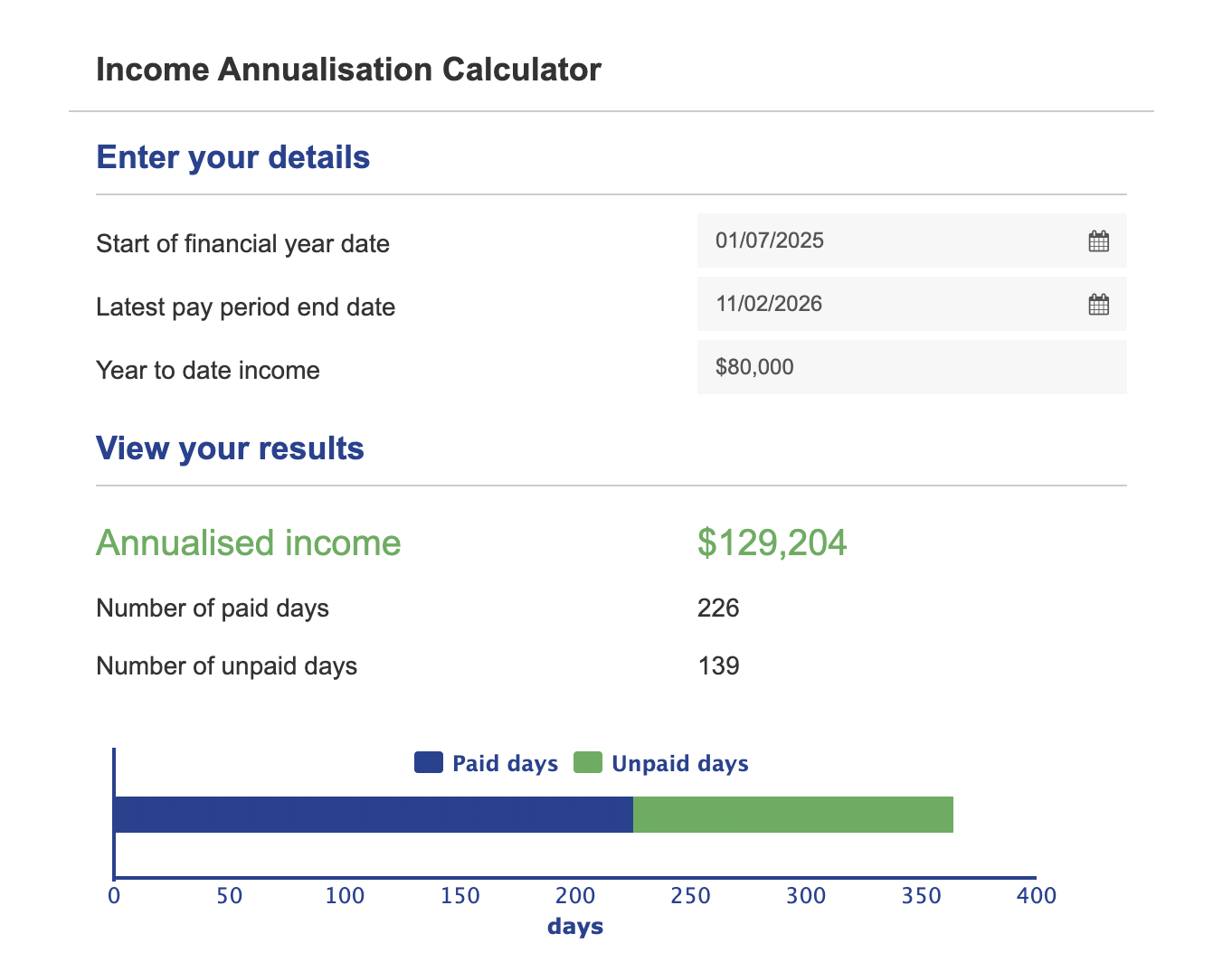

Our income annualisation calculator asks for three key details:

Start of the financial year date

Latest pay period end date

Year-to-date gross income

These inputs allow the calculator to determine how much income has been earned over the paid portion of the year, then project that pace across a full 12-month period.

When this calculator is most useful

This calculator is most accurate when:

Income has already been paid and appears in year-to-date total.

The borrower is partway through the financial year.

Earnings have been reasonably consistent over that period.

For income types such as bonuses, overtime or casual work, the calculator can only annualise what has already been earned. It does not determine how much of that income a lender will ultimately accept.

Worked example

Assume a borrower earns variable income and enters the following details into the calculator:

Start of financial year: 1 July

Latest pay period end date: 31 January

Year-to-date gross income: $48,000

Based on the number of paid days between 1 July and 31 January, the calculator projects the income across a full year. In this example, the result produces an annualised income of approximately $81,448.

From here, a lender would still assess how that income is structured, including whether any portion is variable, discretionary or subject to shading.

Why broker guidance matters

According to The Value of Mortgage and Finance Broking 2025 report by Deloitte and the Mortgage & Finance Association of Australia Value of Mortgage and Finance Broking, 75 per cent of new residential home loans are now arranged through mortgage brokers. A key reason is the growing complexity of income assessment, particularly for borrowers with variable or non-standard income.

A mortgage broker can take the calculator result and assess it against real lender policy. This includes identifying which lenders are more favourable for your income type, how much of your income is likely to be accepted and whether any adjustments are likely to apply before you submit an application.

This step is especially important if you are buying property, seeking pre-approval or making offers based on a borrowing power estimate.

Speak to a mortgage broker for a lender-accurate assessment

Income annualisation is a standard part of modern home loan assessments, particularly when income is irregular or only part of the financial year is available.

While the calculation itself is straightforward, lender adjustments such as shading, averaging and income caps can significantly affect the final assessable income.

If you would like a lender-accurate view of your income, you can speak with a mortgage broker through OurTop10 to understand how your income is likely to be considered by lenders before you apply.

For more tools and guides to help you understand borrowing power, income assessment and property lending, visit our blog.

FAQs

What is income annualisation, and when do lenders use it?

Income annualisation is how lenders project part-year or irregular income across a full 12-month period. It is commonly used when income is variable, when payslips show year-to-date figures or when a borrower has recently changed roles or hours.

How do I calculate annualised income from my YTD payslip?

Lenders divide your gross year-to-date income by the time worked, then project that figure across a full year. Adjustments may still be applied depending on income type and consistency.

What figures (gross vs net) and pay period end date should I enter in the calculator?

Always use gross income, not take-home pay. Enter the exact pay period end date shown on your payslip so income is annualised over the correct timeframe.

How do banks annualise overtime, bonuses, commissions and allowances?

These income types are usually averaged over time and often reduced through shading. One-off or irregular payments are commonly excluded.

What if I changed jobs, hours or started mid-year?

Annualisation can still apply, but lenders will assess whether the new income level is stable and likely to continue. In some cases, they may apply conservative assumptions or request additional evidence before including the income in full.

Can casual, contract or self-employed income be annualised?

Casual and contract income can be annualised with evidence of consistency. Self-employed income is usually assessed using tax returns and financials rather than payslips alone.

Why is annualisation less accurate early in the financial year?

With limited year-to-date data, projections are less reliable. Many lenders prefer several months of income history.

How does annualised income affect borrowing power and approval?

Borrowing power is based on assessable income. Shading or averaging can reduce how much income lenders include, affecting approval outcomes.

With over two decades of experience in Australia’s real estate sector, Mansour has built a career specialising in the acquisition and sale of investment and commercial properties, spanning major metropolitan hubs and regional areas. As the founder and owner of a finance brokerage firm, he manages a loan portfolio exceeding $100 million while serving a broad range of clients nationwide.

A frequent contributor to money.com.au, Mansour has developed a deep understanding of diverse investment strategies, enabling him to provide valuable, well-informed perspectives on market trends and opportunities.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.