Bankwest Home Loan Review

When comparing mortgage products in Australia, borrowers often weigh up factors like deposit size, LVR limits, flexibility, fees, and digital tools before committing to a lender. In this Bankwest home loan review, we’ll take a closer look at how Bankwest positions itself in the home loan market. From features and benefits to drawbacks and refinancing options, this guide provides a clear overview for first-home buyers, refinancers, and investors.

Key Features of Bankwest Home Loans

Bankwest home loans come in a variety of forms to suit different borrower needs:

- Loan-to-Value Ratio (LVR): Borrowers can secure loans up to 95% of the property value. This means only a 5% deposit may be required, although Lenders Mortgage Insurance (LMI) typically applies.

- Interest Options: Fixed and variable rates are available, offering flexibility depending on whether stability or market-linked pricing is preferred.

- Repayment Types: Both principal & interest and interest-only repayments are available, subject to eligibility and loan type.

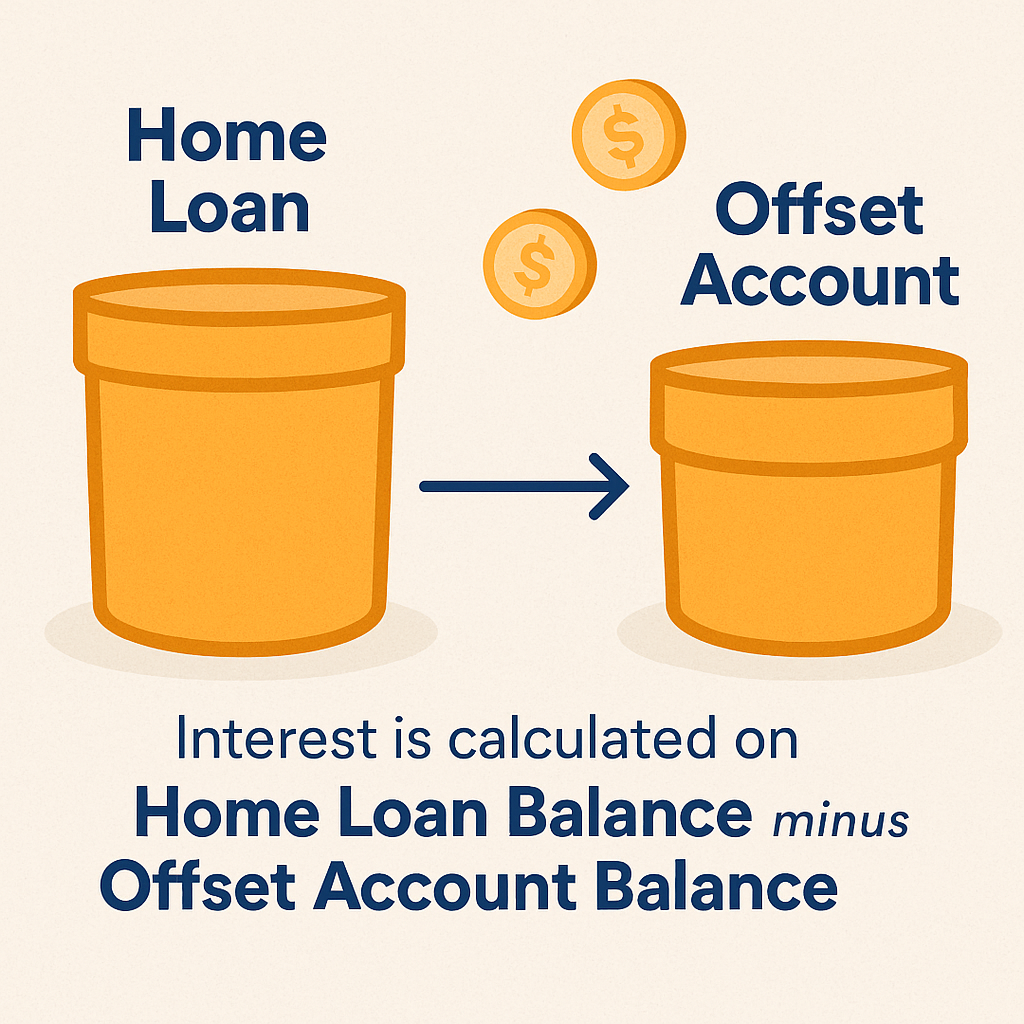

- Offset Accounts & Redraw Facilities: Selected Bankwest products include 100% offset accounts, which can reduce the overall interest payable by linking savings directly to the loan. Redraw options allow access to extra repayments made.

- Loan Terms: Loan lengths generally range from 5 years to 30 years, depending on borrower circumstances.

Bankwest also offers specialised products for investment properties and construction loans, giving borrowers a comprehensive set of choices across the housing journey.

Digital Tools and Bankwest Calculator Options

One standout feature is Bankwest’s suite of online tools. Borrowers can use the Bankwest mortgage calculator and Bankwest calculator range to estimate repayments, borrowing capacity, and potential savings from offset accounts.

These calculators include:

- Repayments Calculator – estimates weekly, fortnightly, or monthly payments.

- Borrowing Power Calculator – gives an idea of how much you may be able to borrow based on income and expenses.

- Stamp Duty & Fees Calculator – helps calculate upfront costs like stamp duty, LMI, and application fees.

For many borrowers, especially first-home buyers, these digital tools simplify planning and reduce the guesswork involved in structuring a loan.

Benefits of Choosing a Bankwest Home Loan

There are several advantages to selecting a Bank west home loan:

- Accessibility with Smaller Deposits

With LVRs up to 95%, Bankwest allows borrowers to enter the property market with only a 5% deposit. This makes home ownership more achievable for Australians who haven’t saved a 20% deposit. - Strong Digital Ecosystem

Borrowers can manage applications, upload documents, and track progress via the Bankwest app. Everyday banking and loan management can also be handled through internet banking. - Offset and Redraw Options

Offset accounts help reduce interest, while redraw facilities provide flexibility for borrowers to access additional repayments if needed. - Pre-Approval for House Hunting

Bankwest offers online pre-approval, giving clarity on borrowing capacity before attending auctions or making private offers. - Part of the CBA Group

Bankwest is backed by the Commonwealth Bank of Australia, meaning borrowers can have confidence in long-term stability and support.

Potential Drawbacks of Bankwest Home Loans

Like all lenders, Bankwest has considerations that may not suit every borrower:

- Lenders Mortgage Insurance (LMI): High LVR loans require LMI, which can add thousands to the loan cost. This is the biggest drawback for those borrowing with less than a 20% deposit.

- Strict Serviceability Tests: Borrowers with casual employment, self-employment, or high existing debt may find it harder to qualify.

- Not Always the Cheapest Option: While competitive, Bankwest’s rates may not be the absolute lowest in the market. Some niche lenders offer cheaper deals, albeit with more limited product flexibility.

- Branch Accessibility: Bankwest has reduced its physical branch presence in some states, meaning many borrowers will primarily interact online or by phone.

Bankwest Refinance Options

Refinancing can be a valuable tool for homeowners who want to secure a better rate, consolidate debt, or unlock equity. Bankwest refinance products are available to borrowers switching from another lender.

Benefits of refinancing with Bankwest include:

- Access to offset accounts and redraw facilities.

- Digital application process that allows refinancing online.

- Potential savings if you move from a higher-rate lender to a Bankwest product.

It’s important to compare refinance offers carefully. While Bankwest may not always provide the largest cashback incentives seen with some major banks, the ongoing features, stability, and digital support can still make refinancing appealing.

Comparison to Alternatives

When compared to other lenders, Bankwest sits firmly in the mainstream banking sector:

- Against No-LMI Lenders: Some lenders provide no-LMI loans up to 85% LVR, but eligibility is limited. Bankwest instead allows up to 95% with LMI, making it more accessible.

- Against Major Banks: While Westpac, NAB, and ANZ all offer similar high LVR products, Bankwest distinguishes itself with strong digital tools and customer support.

- Against Smaller Lenders: Niche lenders may offer slightly cheaper rates, but often lack the same flexibility, offset accounts, or refinance options.

Who Might Consider a Bankwest Home Loan?

A Bankwest home loan may suit:

- First-Home Buyers with smaller deposits who need up to 95% LVR.

- Refinancers seeking stable banking support with offset and redraw.

- Digital-Savvy Borrowers who prefer managing applications and repayments online.

- Property Investors looking for loan features that support tax-effective strategies, such as interest-only repayments.

Application Process

Applying for a Bankwest home loan or Bankwest refinance is relatively straightforward,

- Online Application: Submit an application through the Bankwest website or app.

- Document Upload: Provide income documents, identification, and details of existing commitments.

- Assessment: Bankwest conducts credit checks and serviceability assessments.

- Approval & Settlement: Once approved, funds are released and the loan settles.

Pre-approval is available, helping borrowers understand their budget before committing to property purchases. Speak to an Ourtop10 broker to see the best options available for your home loan scenario.

Using the Bankwest Mortgage Calculator Before Applying

Before applying, many borrowers use the Bankwest mortgage calculator to plan repayments. For example, entering a $600,000 loan at 6% over 30 years shows the approximate monthly repayments, which helps buyers assess affordability.

Using these calculators before applying allows borrowers to:

- Compare fixed vs variable repayment options.

- Test repayment impacts if interest rates rise.

- Understand the impact of extra repayments or offset balances.

Tips for Maximising Value from a Bankwest Home Loan

- Save a Larger Deposit: Even if Bankwest allows 95% LVR, aiming for 80% avoids LMI.

- Use Offset Accounts Strategically: Keeping savings in an offset can significantly reduce long-term interest costs.

- Review Regularly: Even after approval, check your loan against market rates to see if a Bankwest refinance or competitor refinance could save money.

- Seek Professional Advice: While this review is factual, borrowers should always consult a licensed mortgage broker or financial adviser.

Conclusion

This Bankwest home loan review highlights the balance between accessibility and cost. With high LVR loans, offset accounts, strong digital tools, and refinance options, Bankwest provides flexibility for a broad audience. However, costs such as LMI and strict lending criteria must be weighed carefully.

For first-home buyers with smaller deposits, Bankwest home loans provide a path into the property market. For refinancers, the ability to access digital processes and offset facilities may make switching to Bankwest appealing.

Ultimately, the best choice depends on your personal financial circumstances. Always use tools like the Bankwest calculator and Bankwest mortgage calculator to plan, and consider professional advice before making any commitments.

FAQs

- Does Bankwest offer high LVR loans?

Yes, Bankwest provides home loans up to 95% LVR. However, loans above 80% usually require LMI. - What is lenders mortgage insurance (LMI)?

LMI is a one-off cost that protects the lender if the borrower defaults. It is charged when deposits are below 20%. - Can I get an offset account with a Bankwest home loan?

Yes, selected Bankwest home loans include offset accounts, which can reduce the total interest paid. - How does Bankwest compare to other lenders?

Bankwest offers a mainstream option with strong digital tools. Alternatives may include no-LMI lenders or 80% LVR products with lower long-term costs. - What documents are needed to apply for a Bankwest home loan?

Proof of income, ID, and details of debts are typically required. - Does Bankwest offer refinance loans?

Yes, Bankwest refinance options allow borrowers to switch from another lender, potentially accessing lower rates or offset features. - Where can I find repayment estimates?

The Bankwest calculator range and Bankwest mortgage calculator provide detailed repayment and borrowing power estimates.