Introduction

For many first-home buyers in Sydney and other major cities, the challenge has always been saving a 20% deposit to avoid Lenders Mortgage Insurance (LMI). With property prices continuing to climb, reaching that target deposit can take years — often leaving buyers priced out of the market.

Enter the First Home Guarantee (FHBG), part of the Federal Government’s Home Guarantee Scheme. From 1 October 2025, the scheme will undergo its biggest expansion yet. The changes will allow far more Australians to buy with a 5% deposit and no LMI, even on properties worth up to $1.5 million in Sydney.

But while the scheme dramatically lowers the upfront savings hurdle, it’s important to understand the long-term trade-offs. Let’s break it down.

What is the First Home Guarantee Scheme?

The First Home Guarantee is designed to help eligible buyers enter the market sooner by reducing the deposit requirement. Traditionally, if you purchase with less than a 20% deposit, lenders charge Lenders Mortgage Insurance (LMI), which can add tens of thousands to the cost of buying.

Under the scheme:

- Buyers can purchase with as little as 5% deposit.

- The government acts as a guarantor on the remaining 15% of the deposit.

- No LMI is payable, saving buyers a significant upfront cost.

The 2025 Changes

From 1 October 2025, the scheme becomes far more generous:

- Unlimited places: no longer capped at a set number of participants.

- No income caps: previously, buyers had to meet strict income limits.

- Higher price caps: in Sydney, the cap increases from $900,000 to $1.5 million.

This means a $1.25 million property in Sydney will soon qualify — something previously out of reach.

Case Study: Buying a $1.25 Million Property in Sydney

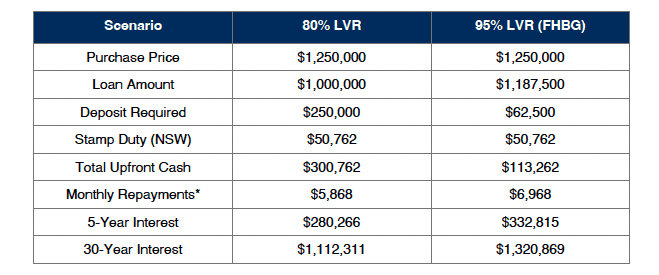

Let’s compare two scenarios for a first-home buyer in Sydney purchasing a $1.25m property.

*Assumes a 30-year loan term at 5.80% p.a., principal & interest repayments.

Key difference: Nearly $188,000 less cash upfront is needed with the FHBG, but borrowers face $52,500 more interest in the first 5 years and over $200,000 more across 30 years.

Repayments and Interest

At identical rates, 95% LVR borrowers pay around $1,100 more per month and an additional $208,000 in lifetime interest.

If lenders apply a small high-LVR loading (e.g., +0.20%), the difference grows:

- +$1,253 per month

- +$64,000 more interest in 5 years

- +$263,000 more over 30 years

Stamp Duty: The Unavoidable Cost

While the FHBG removes LMI, it doesn’t change stamp duty.

- On a $1.25 million property in NSW, stamp duty is $50,762.

- First Home Buyer Assistance Scheme (FHBAS) concessions don’t apply above $1 million.

This remains a significant upfront cost that buyers need to budget for.

Pros of the FHBG

- Enter the market years sooner with a much lower deposit.

- No LMI, which can save $30,000–$70,000 on a property at this price point.

- Benefit from property growth sooner instead of waiting to save.

Cons of the FHBG

- Higher repayments: 95% LVR loans are larger and may come with higher rates.

- More interest paid over the life of the loan.

- Still need to cover stamp duty and other costs.

Expert Insight

“This is a game-changer for Sydney first-home buyers,” says Mansour Soltani, Director of Soren Financial and finance contributor at OurTop10.com.au.

“At 95% LVR under the First Home Guarantee, buyers can enter the market with nearly $188,000 less cash upfront. However, they will pay around $53,000 more in interest in the first five years and more than $200,000 extra over the life of the loan compared to an 80% LVR borrower. It’s about weighing the benefit of getting in sooner against the long-term cost.”

FAQs

Q: Does the First Home Guarantee Scheme cover stamp duty?

No. Buyers must still pay stamp duty and other fees.

Q: Can I buy an investment property under the scheme?

No. It is limited to owner-occupiers.

Q: What happens if I sell the property early?

The guarantee ends — your loan continues under standard lending terms.

Q: Is the scheme available everywhere in Australia?

Yes, but price caps differ by state and region. From October 2025, caps rise significantly, including $1.5m in Sydney.

Conclusion

The First Home Guarantee Scheme is set to change the game for buyers in Sydney from October 2025. By reducing the deposit hurdle, it makes entering the market far more accessible — especially for properties previously out of reach.

But with the benefit of a lower deposit comes the reality of higher repayments and more interest over time. The scheme can be a powerful tool for the right buyer, but it’s essential to seek professional advice, run the numbers, and ensure you’re comfortable with the trade-offs.

For more insights and comparisons on first-home buyer schemes, visit OurTop10.com.au.