Choosing the right mortgage broker is crucial to your home loan journey. To ensure a positive experience, avoid the following common mistakes:

Relying Solely on Recommendations from Family and Friends

While recommendations from family and friends can be valuable, they should not be the sole basis for your decision.

Each person’s financial situation and preferences are unique, so it’s essential to conduct your own research and assess the broker’s suitability for your specific needs.

What you should be looking for is the best mortgage broker Melbourne has to offer (assuming that Melbourne is where you are located).

Not Asking Enough Questions or Clarifications

Effective communication is key when working with a mortgage broker. Don’t hesitate to ask questions and seek clarifications regarding any aspect of the loan process that you don’t fully understand.

A reliable broker will patiently address your concerns and provide clear explanations.

Neglecting to Review the Broker’s Commission Structure

Mortgage brokers are compensated through commissions paid by lenders. It’s important to understand how the broker’s commission structure works and how it may influence their recommendations.

Ensure that the broker is transparent about their fees and discloses any potential conflicts of interest.

Failing to Understand the Terms and Conditions of the Loan

Read the terms and conditions of the loan thoroughly before committing to any agreement.

Understand the interest rate, repayment terms, fees, and any potential penalties associated with the loan. If you have any doubts or concerns, consult your mortgage broker for clarification.

By avoiding these common mistakes, you can make a more informed decision when selecting a mortgage broker and secure a loan that aligns with your needs.

The Role of Mortgage Brokers in the Home Loan Market

Mortgage brokers play a significant role in the home loan market, facilitating the borrowing process and providing valuable services to borrowers.

Let’s explore their impact on the lending industry:

Impact of Mortgage Brokers on the Lending Industry

Mortgage brokers have reshaped the lending industry by connecting borrowers with lenders and streamlining the loan application process.

They offer borrowers access to a wide range of loan products and lenders that may not be easily accessible otherwise.

This competition among lenders has driven improved loan terms and conditions, benefiting borrowers.

Regulation and Licensing Requirements for Brokers

Mortgage brokering is a regulated profession to protect consumers and ensure industry standards are upheld.

In Australia, mortgage brokers are required to be licensed by the ASIC. Licensing involves meeting specific educational and professional requirements and adhering to a code of conduct to maintain ethical practices such as best interests duty which means that they look after the clients interests.

Growth and Demand for Mortgage Brokering Services

The demand for mortgage brokering services continues to grow, driven by the complexity of the lending landscape and the desire for expert guidance.

Borrowers value the convenience, personalised advice, and access to a broader range of loan options that mortgage brokers provide.

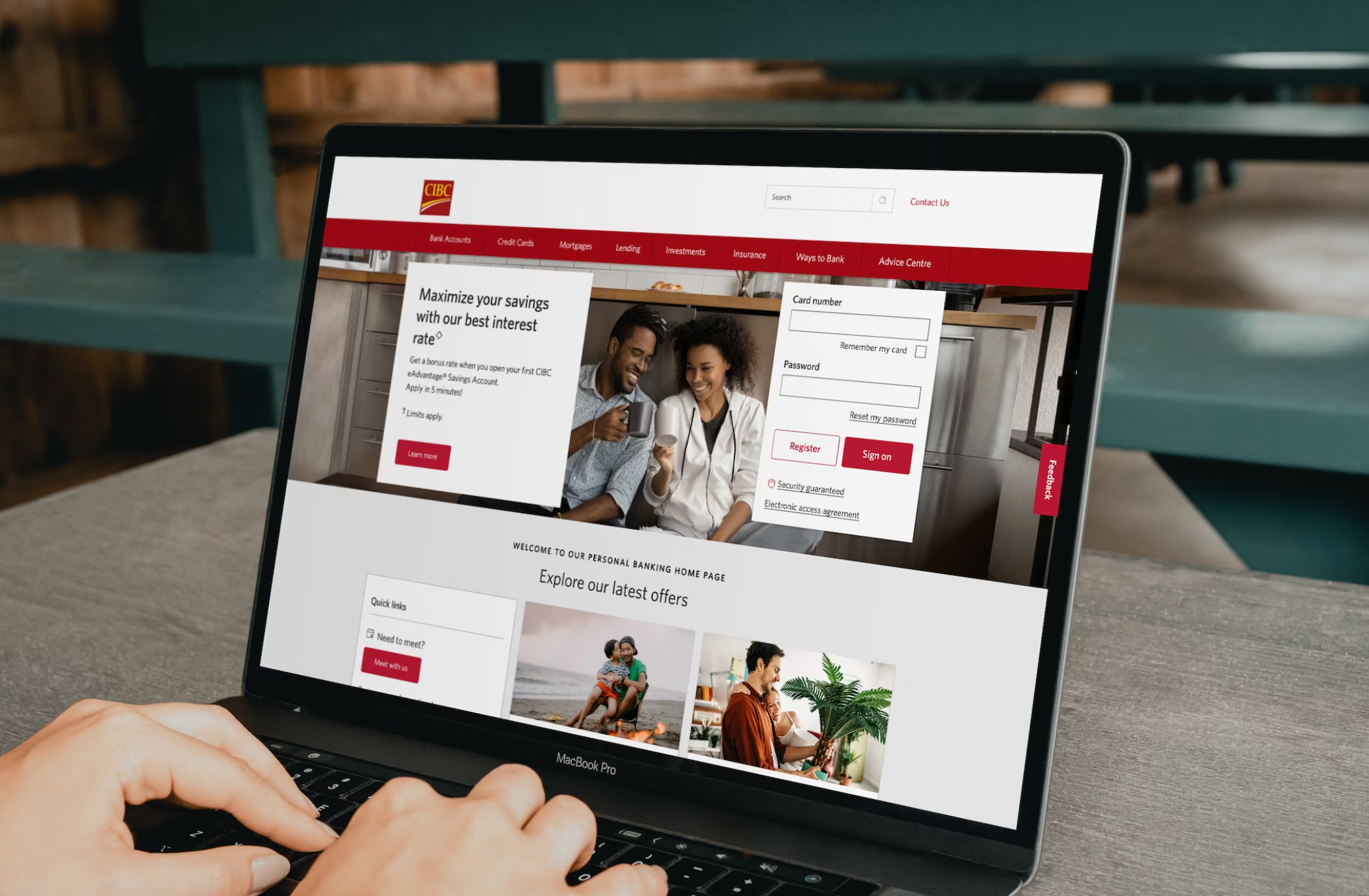

As the market evolves, mortgage brokers are adapting to technological advancements and leveraging digital platforms to enhance their services.

Choosing the Right Mortgage Product for Your Needs

When selecting a home loan, it’s essential to consider your specific needs and preferences. Here are key factors to evaluate:

Different Types of Home Loans Available

There are various types of home loans available, including fixed-rate loans, variable-rate loans, interest-only loans, and loans for either an investment property or an owner occupier.

Each type has its own features and benefits, so it’s crucial to understand them and choose one that aligns with your financial goals and risk tolerance.

Factors to Consider When Reviewing Suitable Loans

Consider the following factors when selecting a home loan:

- Interest Rates: Compare the rates offered by different lenders to secure a competitive rate that suits your budget.

- Loan Terms: Evaluate the loan terms, such as the loan duration and repayment frequency, to ensure they are manageable for you.

- Repayment Options: Assess the repayment options available, such as principal and interest or interest-only payments, to determine what works best for your financial situation.

- Fees and Charges: Review the fees associated with the loan, including application fees, ongoing fees, and any potential exit fees.

- Additional Features: Some home loans offer additional features such as offset accounts, redraw facilities, or the ability to make extra repayments. These features are especially valuable when you are purchasing an investment property. Consider whether these features align with your needs.

Understanding these factors will help you make an informed decision and select a loan that suits your requirements.

The Future of Mortgage Brokers in Melbourne

As technology continues to shape the mortgage industry, the future of mortgage brokers in Melbourne looks promising. Here are some key trends and considerations:

Technological Advancements in the Mortgage Industry

Technological advancements are transforming the mortgage industry, enhancing the efficiency and convenience of loan processes.

Mortgage brokers are adopting digital tools and online platforms to streamline application processes, improve communication with clients, and access real-time market information.

Embracing these advancements allows brokers to provide faster and more efficient services to borrowers.

Changing Consumer Preferences and Expectations

Consumer preferences are evolving, and borrowers expect a seamless and personalised experience throughout the mortgage journey.

Mortgage brokers must adapt to these changing expectations by delivering tailored solutions, leveraging data-driven insights, and providing exceptional customer service.

Building strong relationships and trust with clients will be vital to their success.

Potential Challenges and Opportunities for Mortgage Broking

While the mortgage brokering industry faces challenges such as regulatory changes and increased competition, it also presents significant opportunities.

The demand for expert advice and assistance in navigating the complex lending landscape remains high.

Mortgage brokers can leverage their expertise, adapt to market dynamics, and embrace innovative technologies to stay ahead of the curve.

In conclusion, partnering with the best mortgage broker in Melbourne can make a substantial difference in your home loan journey.

They offer access to a wide range of lenders and products, provide guidance, and save you time and effort.

By following the steps outlined in this article, conducting thorough research, and considering the factors discussed, you can secure a home loan that suits your needs and financial goals.

Conclusion

Securing a home loan is a significant financial decision, and finding the best mortgage broker Melbourne has to offer is crucial to ensuring a smooth and successful borrowing experience.

In this article, we explored the roles and responsibilities of mortgage brokers, the benefits of working with them, and the steps involved in finding the right broker and securing a home loan.

We discussed the importance of researching reputable brokers, checking their credentials and experience, reading client reviews, and comparing rates and fees.

We also highlighted the advantages of hiring a mortgage broker, including access to a wide range of lenders and loan products, guidance throughout the process, and the ability to negotiate better loan terms.

Furthermore, we provided a detailed overview of the steps involved in securing a home loan with a mortgage broker, from the initial consultation to the settlement.

Additionally, we discussed common mistakes to avoid when choosing a mortgage broker and emphasised the role of brokers in the home loan market.

We explored the impact of mortgage brokers on the lending industry, the regulatory and licensing requirements they must meet, and the growing demand for their services as they manage the entire process.

Lastly, we emphasised the importance of choosing the right home loan for your needs by considering factors such as rates, loan terms, repayment options, fees, and additional features.

In the ever-evolving mortgage industry, mortgage brokers in Melbourne are adapting to technological advancements, catering to changing consumer preferences, and embracing the challenges and opportunities that lie ahead.

FAQs

1. What is a mortgage broker?

A mortgage broker is a licensed professional who acts as an intermediary between borrowers and lenders.

Their role is to assess borrowers’ financial situations, recommend suitable loan products, and facilitate the loan application process.

2. How do I find the best mortgage brokers Melbourne has to offer?

To find the best mortgage broker in Melbourne, you can use OurTop10 list here.

We still recommend that you conduct thorough research, check their credentials and experience, read client reviews and testimonials, and compare interest rates and fees offered by the broker VS what is on the lender website (they should be the same).

Additionally, consider their knowledge, expertise, and ability to understand your specific requirements. Also ask them if they can have any fees waived by the lender.

We also recommend that you use a broker that belongs to a mortgage and finance association, that they are accredited mortgage brokers, and that they hold a financial services advanced diploma.

3. Do I need to pay a fee to the mortgage broker?

Mortgage brokers are typically compensated through commissions paid by lenders.

However, some brokers may charge additional fees for their services. It’s important to discuss the broker’s fee structure upfront and understand the costs involved.

4. Can a mortgage broker help me refinance my existing home loan?

Yes, mortgage brokers can assist with refinancing your existing home loan.

They can review your current loan, assess your financial goals, and recommend suitable refinancing options that may offer better terms, lower interest rates, or additional features.

5. How long does the mortgage process typically take?

The mortgage process can vary depending on various factors including:

1. The complexity of your financial situation

If you are purchasing via other investment vehicles such as a trust or self managed super fund or if you need to apply for a government grant, this requires extra work for which the broker is not paid for and as such, they may charge for this.

2. The lender’s processes and service level agreements at the time of lodgement

Every lender’s application/process times are different and as such you should ask how long the lender will take to give you a result.

- Other external factors.Other external factors such as valuations and access to the property in question come in to play, as the lender will engage a valuer to view the property. The faster you can gain them access, the faster the result.

On average, it can take anywhere from a few weeks to a couple of months from the initial application to settlement.

Working with a mortgage brokers Melbourne has to offer can help streamline the process and ensure timely completion.

Summary

Choosing mortgage can be a daunting task, since purchasing a property is generally the largest purchase that an individual will make, we recommend that you engage a professional to assist in your lifetime financial solutions.

Things we recommend you do:

When reviewing the best mortgage brokers Melbourne has to offer, make sure that they belong to a mortgage and finance association of Australia.

Make sure that they are accredited member of either the MFAA or FBAA and that their recent professional education includes a mortgage broking diploma.

Check the mortgage broker’s online reviews so you can get perspective on previous client experiences and what you can expect from your chosen mortgage broker in Melbourne.

Check out our list of accredited brokers here.

Things we recommend that you do not do:

Do not take recommendations from people who are not professionals, especially when it comes to your financial success.

Ask lots of questions during the process, this will aid you now and in the future. Try to learn as much as possible so you can process the information correctly that is being presented to you.

FAQs for Selecting a Mortgage Broker Near Me

A mortgage broker is a licensed expert who connects borrowers with lenders, helping you secure favorable mortgage terms and rates.

A mortgage broker can save you time and money by accessing numerous lenders, offering professional advice, and negotiating better terms on your behalf.

To find a trustworthy mortgage broker, seek recommendations from friends and family, read online reviews, verify their credentials, and look for membership in professional bodies like the Mortgage & Finance Association of Australia (MFAA).

Choose a mortgage broker with a solid reputation, extensive experience, transparent fee structure, strong communication skills, and a broad network of lenders. Ensure they understand your financial needs and goals.

Mortgage brokers typically earn a commission from the lender once your loan is finalized. Some may charge a service fee, so discuss payment arrangements upfront.

Inquire about their experience, the lenders they work with, their fees, how they will secure the best deal for you, any potential conflicts of interest, their process, and how they will keep you informed.

Yes, mortgage brokers can help with various home loans, including first home buyer loans, investment property loans, refinancing, and loans for self-employed individuals.

The timeline can vary, but it usually takes a few weeks from the initial consultation to loan approval. Your broker will guide you through each step and provide updates on the timeline.

You will need to provide identification, proof of income, expense details, information on existing debts, and possibly bank statements. Your broker will give you a comprehensive list of required documents.

A mortgage broker can offer more choices and potentially better deals since they work with multiple lenders. Banks only offer their own products, which may limit your options.

Yes, a mortgage broker can help you find lenders willing to approve loans for individuals with low credit scores and offer advice on improving your creditworthiness.

A local mortgage broker has in-depth knowledge of the regional market, understands local property trends, and can provide personalized service. They often have established relationships with local lenders.

Verify that your mortgage broker is licensed and a member of a professional association. They should provide clear and transparent information, answer your questions thoroughly, and have a good reputation for client satisfaction.

Once you’ve selected a mortgage broker, schedule a consultation to discuss your needs and financial situation. Provide the necessary documentation, and they will begin searching for the best loan options for you.

MANSOUR SOLTANI

With over two decades of experience in Australia’s real estate sector, Mansour has built a career specialising in the acquisition and sale of investment and commercial properties, spanning major metropolitan hubs and regional areas. As the founder and owner of a finance brokerage firm, he manages a loan portfolio exceeding $100 million while serving a broad range of clients nationwide.

A frequent contributor to money.com.au, Mansour has developed a deep understanding of diverse investment strategies, enabling him to provide valuable, well-informed perspectives on market trends and opportunities.