Australia’s growing mortgage stress issue

Growing mortgage hardship in Australia as the RBA cash rate hits 3.6% which pushes up interest rates, and increases home loan repayments.

Since the early 2000s, Australia’s housing market has experienced an extraordinary boom. This has caused a huge growth in a wide range of businesses, including those in finance, construction, and legal services, which has been great for the broader economy, creating jobs and prosperity.

Fast forward to 2023, according to a recent analysis by Digital Financial Analytics, almost 40% of Australian households are suffering from mortgage stress. This is defined as spending more than thirty percent of their income on mortgage payments. Though mortgage brokers and financial advisors can help, here’s a rundown what you need to know about these rates and how it’ll impact you as a homeowner.

What does this mean for the broader economy?

The broader consumer confidence has worsened as a result of the current economic situation, which has resulted in job losses across multiple industries starting with the tech and construction sectors.

We have also seen decreased income, increased home loan repayments for existing customers within the banking sector as the variable interest rate rises.

This is exacerbated by increased living expenses for everyone via high inflation, (the word inflation refers to persistent, widespread price rises).

Why is mortgage stress a concern?

The increase in mortgage stress has been especially severe in major cities like Sydney and Melbourne, where home loan sizes are large and many households have recently increased the size of their household debts.

The significant rise is mainly due to upsizing, renovating, or buying investment properties/share portfolios.

Several economists from all the major banks (like commonwealth bank, Westpac, ANZ) forecast additional rate hikes in the coming months, as central bank s across the world hike rates, thus the situation is not going to improve very soon.

Many homeowners do remain hopeful about the future of the real estate market, despite mounting concerns about mortgage stress and wage growth.

Many believe that the current interest rate increases are a temporary spike and that the property market in the major capital cities of Australia will continue to expand over the long term, as interest rates are still quite cheap compared to historical high levels.

What are the cash rate changes?

The 10 recent consecutive cash rate rises passed down from the reserve bank has lifted the official cash rate from 0.10 to over 3.6% and is expected to head to approximately 4.10%.

This has resulted in a significant rise in monthly repayments due to lenders such as commonwealth bank increasing their interest rates to home loan borrowers.

The end result which has increased the burden on struggling households already trying to make ends meet. In 2021 interest rates were sitting at below 2% for an owner occupied property sitting with a loan value ratio (LVR) of 80%.

That same loan is now costing 5.25% and interest rates are still climbing.

RBA interest rate rises

The reserve bank of australia’s position and reasoning around the rate rises is to do with the rising cost of living pressures (inflation) however the true reason goes much deeper and has to do with fiscal policy around money printing (but we will leave that topic for another post).

The short version is when you print lots of money, the value goes down and inflation goes up.

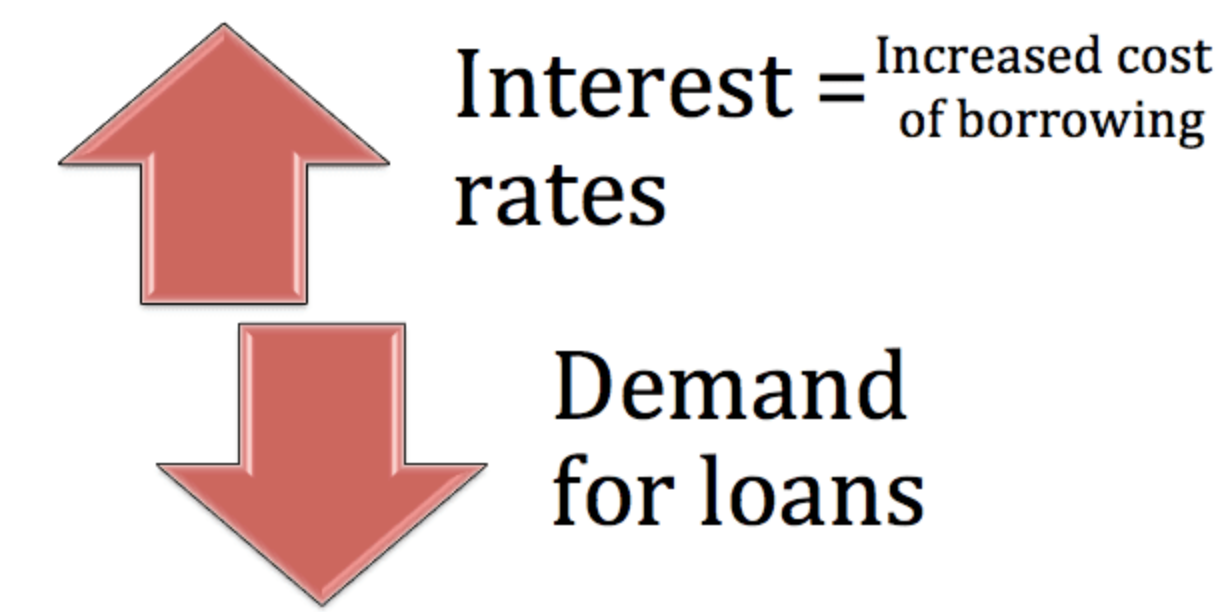

What is happening to interest rates?

In the short term, as long as the reserve bank of australia continues with their policy of attempting try to curb inflation via cash rate increases, the interest rates will continue to climb.

However many economists believe that we are at the tail end of the interest rate cycle and we are already seeing rate rises increase by 0.25% instead of 0.5%. This suggests that we should start seeing rate increases less regularly and eventually stop.

The high interest rates will then start to decrease to normal levels of around 4-5% for a variable home loan.

What this means for your mortgage repayments

Obviously this means that your monthly mortgage repayments are going to increase with every rate rise as the big banks pass on this cost, however it is the knock on affects to the economy that are going to cause issues that may be longer lasting.

People tighten their belts and household budgets are monitored with much more scrutiny. Restaurants, gym memberships, holidays, car upgrades the list goes on and on.

However if you work in an industry such as travel, hospitality, leisure and fitness then your job may be at risk.

There is usually a rise in the unemployment rate, which has been sitting at record lows and only has one way to go. Savings accounts will start to diminish as people will need to dip into savings to pay fixed costs like their home loan, credit cards and other bills.

This will be especially prevalent when we hit the mortgage cliff in the 2nd quarter of 2023, (a term you may have heard in the media recently).

The mortgage cliff refers to the large number of fixed rate home loans that will be expiring and moving to a much higher interest rate.

The sudden change will affect the financial situation of many households and cause financial difficulty, throwing many into needing hardship assistance and affect household spending across the broader economy.

How much more you will pay in 2023

Well it is all relative, interest rates are returning to what we would call normality. The anomaly was really during the peak of covid where interest rate were sitting at just under 2%.

Existing customers who were locked in at these rates will have their interest rates expiring soon. These cohort will definitely feel the difference as the interest rates for an owner occupier home loan is now sitting at 5.25-5.5%

Mortgage rate predictions

As the global economy slows down, the labour market in Australia has seen a shift in costs and availability of skills. This has created a shortage in goods and services as well as a sharp increases in the costs of these same goods and services.

No one has a crystal ball however economists from the big banks are expecting a return to lower rates in 2024 so the best things home owners can do is watch their house hold expenditure, pay down debt and save as much as they can.

Summary

The old saying “what goes up must come down” is relevant in this existing period, we say this period during the global financial crisis in 2008.

However there is no point in thinking about the doom and gloom as this is not in your control. The best way to get through economic uncertainty is to create certainty in your own life. Here are some tips:

- Save as much as you can

- Put off/delay unnecessary expenditure

- Create job security by working in an industry that is least affected

- Pay down/get rid of debts such as personal loans and credit cards, become laser focussed on closing these types of accounts

TORI DUNLAP

Tori is a finance blogger and researcher at OurTop10.com.au, where she enjoys helping people navigate the world of finance and money. Through her insightful articles and comprehensive research, she empowers readers with valuable knowledge on budgeting, saving, investing, and retirement planning.

Tori’s approachable and empathetic style makes complex financial concepts relatable and easier to understand, She aims to foster a sense of community and leave a lasting, positive impact on her audience’s financial well-being.