Introduction: Understanding CBA Home Loans

The Commonwealth Bank of Australia (CBA), often referred to as CommBank, is one of the nation’s largest and most trusted lenders. With its long history, extensive product range, and nationwide presence, a home loan CBA option is often considered by first home buyers, investors, refinancers, and families alike.

A Commonwealth Bank mortgage or CBA home loan is designed to cover a wide variety of borrower needs. From low-deposit entry products to investor-friendly packages, Commonwealth Bank home loans are known for combining flexibility with the stability of a major lender.

In this detailed CBA home loan review, we will explore the full suite of features, benefits, drawbacks, and application processes. We’ll also compare Commonwealth Bank mortgages with alternatives to help borrowers understand where a home loan Commbank product may fit into their financial strategy.

Key Features of CBA Home Loans

CBA provides one of the broadest ranges of home loan products in Australia. Some standout features include:

- Loan-to-Value Ratio (LVR): Borrowers with a deposit of 20% or more can access standard CBA home loans without paying Lenders Mortgage Insurance (LMI). Those with smaller deposits (as low as 5%) may still qualify but must factor in the cost of LMI.

- Interest Rate Options: Borrowers can choose from variable rates, fixed rates (up to 5 years), or a split loan that combines both.

- Repayment Types: Options include principal and interest (P&I) repayments, or interest-only terms for eligible investors.

- Additional Features: Many products come with offset accounts, redraw facilities, and packaged benefits that can reduce fees and interest costs.

- Digital Support: The Commbank app and online banking tools give borrowers full visibility over their loan, repayments, and redraw capacity.

These features make Commonwealth Bank home loans suitable for a wide range of customers, from first-time buyers to seasoned investors.

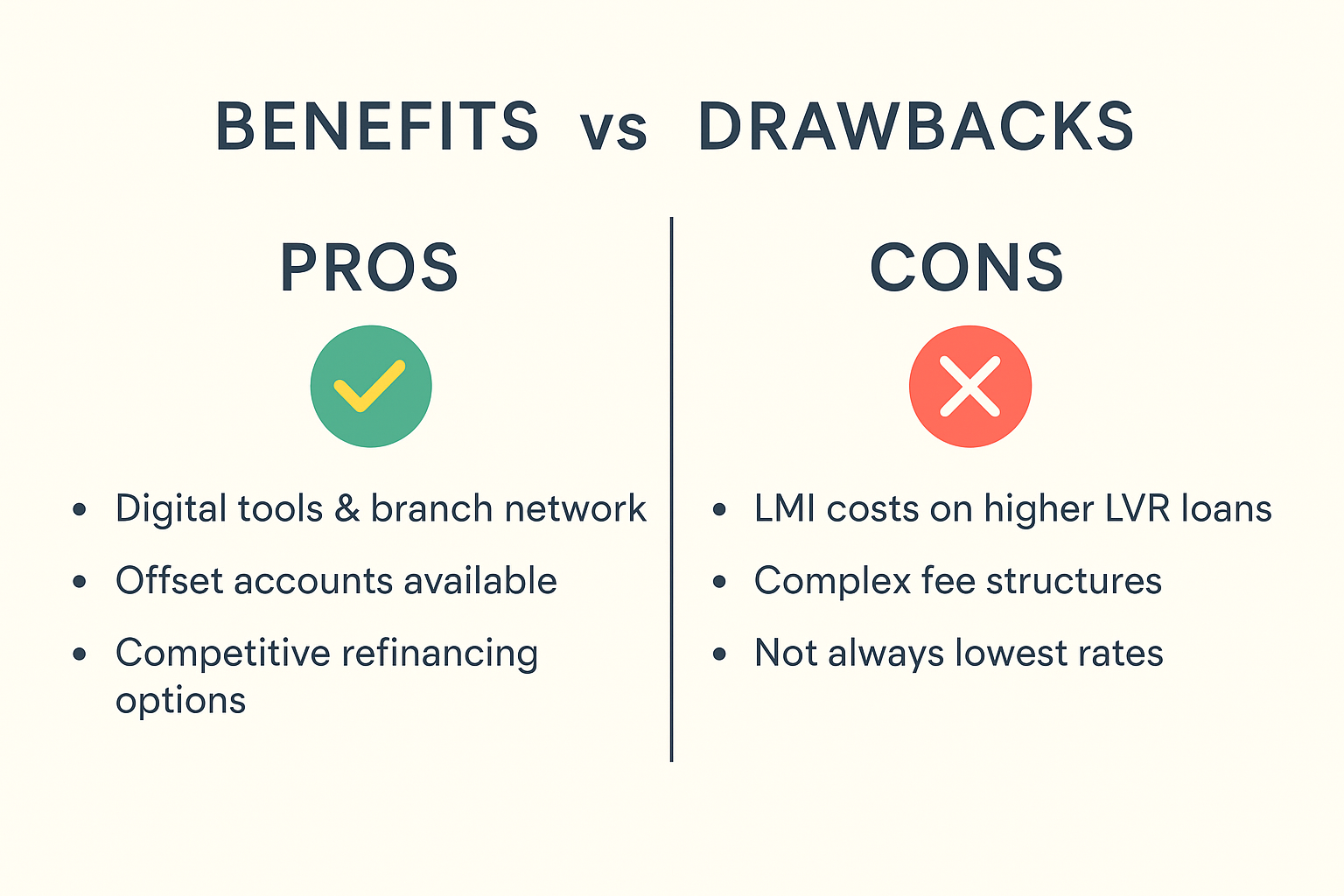

Benefits of Choosing a CBA Home Loan

Opting for a CBA home loan comes with several advantages:

- National Presence and Trust

CBA’s status as one of the “big four” banks means borrowers have access to an extensive branch and ATM network, making Commonwealth Bank mortgages highly accessible across urban and regional areas. - Comprehensive Digital Tools

The Commbank home loan experience is enhanced by award-winning digital services. Borrowers can calculate repayments with the CBA mortgage calculator, manage offset accounts, and even apply online. - Product Variety

From low-deposit loans to packages with multiple banking services, CBA home loans cater to diverse financial needs. - Support for Refinancers

Those looking to switch lenders will find streamlined processes, digital document uploads, and structured guidance. This makes a home loan Commbank refinance option attractive for many. - Offset Accounts and Redraw

Features such as multiple offset accounts and redraw facilities allow borrowers to reduce interest over the life of the loan, a key benefit of Commonwealth home loans.

Drawbacks of CBA Home Loans

Despite the benefits, there are some considerations with CBA home loans:

- LMI Costs for High LVR Loans

Borrowers with less than a 20% deposit typically must pay Lenders Mortgage Insurance (LMI). For a large property purchase, this can mean thousands of dollars added to upfront costs. - Complex Fee Structures

While packages can save money, some borrowers find that Commonwealth Bank lending products have higher ongoing fees compared to smaller banks and credit unions. - Interest Rate Competitiveness

Although Commbank home loans are stable and flexible, they may not always advertise the lowest interest rates. Non-bank lenders and online banks sometimes undercut the big four. - Strict Assessment Policies

Like other major banks, CBA applies detailed serviceability tests, which can be challenging for self-employed borrowers or those with complex income streams.

Types of Commonwealth Bank Home Loans

The Commonwealth Bank home loan range includes multiple categories:

- Standard Variable Rate Home Loans – flexible repayments and offset options.

- Fixed Rate Home Loans – stability for budgeting with fixed repayments.

- Split Loans – combine fixed and variable features.

- Low Deposit Loans – available with LMI for deposits as low as 5%.

- Investor Loans – interest-only repayments and tailored packages.

- Refinancing Options – structured processes for switching lenders.

Each type of CBA home loan caters to a specific borrower segment, ensuring wide applicability across different life stages.

Refinancing with CBA

A significant portion of borrowers explore home loan refinance CBA options. Refinancing with CBA can help:

- Secure a lower interest rate.

- Consolidate multiple debts into one loan.

- Access equity for renovations or investments.

- Switch from interest-only to principal-and-interest repayments.

The Commbank refinance process is supported by digital applications, making it faster for existing borrowers to transition into a new product.

Comparison: CBA vs Other Lenders

When comparing Commonwealth Bank mortgages to other big four banks:

- NAB – Known for strong investor lending products.

- ANZ – Often highlights digital innovation and flexibility.

- Westpac – Competitive packages with cashback refinance offers.

Compared to smaller lenders, Commonwealth Bank home loans offer more extensive features and brand reliability. However, non-banks and credit unions sometimes provide cheaper rates and simpler products.

Who Should Consider a CBA Home Loan?

A home loan CBA may be suitable for:

- First Home Buyers – especially those comfortable paying LMI.

- Investors – who want interest-only options and digital management tools.

- Refinancers – seeking the stability of a major bank.

- Families – who value offset accounts and branch access.

Borrowers prioritising trust, reliability, and nationwide support often lean towards CBA home loans, while those focused solely on the lowest cost may prefer smaller competitors.

Application Process for CBA Home Loans

Applying for a Commonwealth Bank mortgage typically involves:

- Pre-Approval – to understand borrowing capacity before house-hunting.

- Full Application – requiring proof of income, ID, bank statements, and asset/liability details.

- Valuation & Approval – property valuation and credit checks are finalised.

- Settlement – funds are released and the property purchase is completed.

Borrowers can apply online, by phone, or in-branch, giving flexibility to both tech-savvy and traditional applicants. .Speak to an Ourtop10 broker to see the best options available for your home loan scenario.

Digital Tools: The Commbank App Advantage

One of the standout features of a Commbank home loan is the integration with the CommBank app. This includes:

- Real-time repayment tracking.

- Redraw and offset management.

- Notifications for due payments.

- Loan calculators for future planning.

This digital edge makes CommBank home loans particularly attractive for younger buyers and investors who value convenience.

Conclusion

A home loan CBA represents one of the most established and flexible options in the Australian lending landscape. Backed by the strength of a major bank, Commonwealth Bank mortgages provide borrowers with a wide choice of products, digital convenience, and nationwide support.

While drawbacks such as LMI costs, potentially higher fees, and rate competitiveness are worth considering, many Australians continue to trust CommBank home loans for their stability, features, and accessibility.

FAQs about CBA Home Loans

- Does CBA offer high LVR loans?

Yes, CBA home loans above 80% LVR are available but usually require LMI. - Can I refinance with CBA?

Yes, Commonwealth Bank lending includes structured refinance options with digital tools. - What deposit is required for a CBA home loan?

Generally 20% to avoid LMI, though smaller deposits are accepted with added costs. - What repayment options are available?

Both principal & interest and interest-only repayments are possible, depending on borrower eligibility. - How do I apply for a CBA home loan?

Applications can be submitted online, via phone, or in-branch, with pre-approval available before purchase.