Choosing when to secure your home loan interest rate can significantly impact what you repay over time. In Australia, interest rates can change between loan application and settlement, and without a rate lock feature, borrowers receive the rate available on the day their loan settles, not the rate they applied for.

That gap is exactly why many borrowers look into options that reduce uncertainty. In this guide, we explain how interest rate locks work, when it makes sense to use one, when waiting may be the better option and how strategies like split loans and partial locks can help you balance assurance with flexibility.

What is a rate lock feature?

A rate lock feature allows a borrower to secure a fixed interest rate during the home loan application process. Once activated, the lender agrees to honour that rate for a set period, even if market rates rise before settlement.

In Australia, rate locks:

- Are typically available on fixed-rate loans

- Must be requested at the beginning of the application

- Usually apply for 60 to 120 days, depending on the lender

Why borrowers choose to lock their rate

Most borrowers consider a fixed-rate lock to manage uncertainty between application and settlement.

Without a rate lock feature:

- The interest rate is set at settlement, not at application.

- Any lender repricing before settlement can increase repayments.

- Late changes can affect affordability or borrowing confidence.

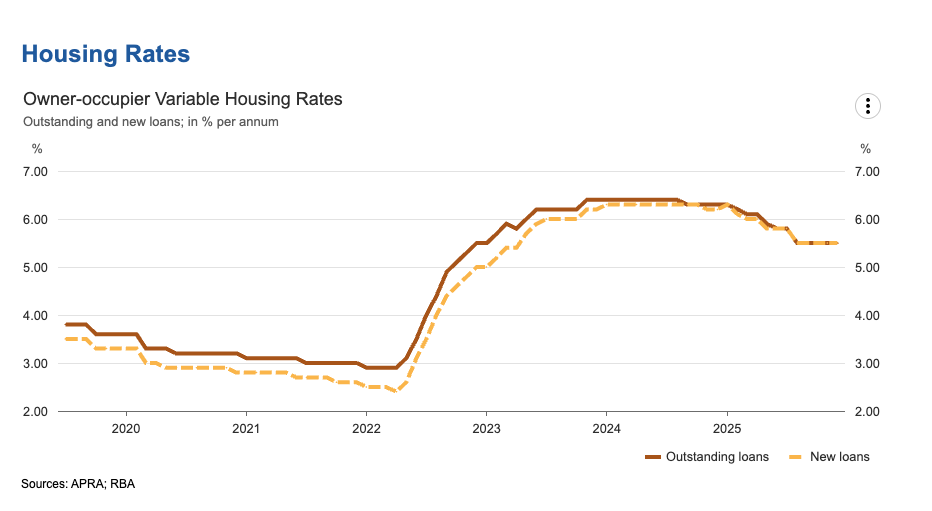

Housing lending rate data from the Reserve Bank of Australia and the Australian Prudential Regulation Authority show that in 2025, average home loan interest rates experienced several repricing periods across the year. Even though rates generally eased, the repeated changes underscore how pricing can fluctuate over the life of a loan application.

Source: APRA, RBA

The benefits of locking your rate

A rate lock feature can be specific in situations, but its value depends on how it fits into your broader loan and settlement plans. Rather than being a one-size-fits-all solution, it is best viewed as a tool that offers predictability during specific stages of the borrowing process.

Protection from rate increases

If fixed rates rise after you apply, a rate lock feature can help you retain the rate you planned around. This can be particularly valuable when approval and settlement timelines are tight.

More predictable repayments from day one

Locking early allows borrowers to plan repayments with greater confidence. This clarity helps manage other property-related costs alongside the loan.

A buffer for longer settlement periods

Longer settlement windows increase exposure to repricing. Off-the-plan purchases and construction loans are common examples where a rate lock feature can reduce volatility.

Trade-offs to consider

While an interest rate lock can provide peace of mind, it also comes with trade-offs that are worth understanding before you commit. These considerations are less about whether locking is “good” or “bad” and more about whether the timing and cost align with your circumstances.

Missing out if rates fall

If rates decrease after you lock, most lenders will not automatically pass on the lower pricing. This is the cost of protecting against rate increases.

Upfront costs

Rate lock features usually come with a fee, which is often non-refundable. This cost applies regardless of whether rates rise or fall.

Expiry risk

If the settlement is delayed beyond the lock period, the rate lock may lapse. This can lead to repricing or additional costs if an extension is required.

Rate lock fees in Australia

Rate lock fees vary by lender and loan product, but generally fall into two categories:

Fee type | Typical range | Example |

Flat fee | $395 to $750 | $595 upfront |

Percentage-based | 0.10% to 0.15% of loan amount | $1,200 on an $800,000 loan |

These fees apply before settlement and are separate from break costs, which may apply after settlement if a fixed-rate loan is exited early.

When locking your rate makes sense

There are scenarios where locking your rate can be a practical decision, particularly when timing and certainty are higher priorities than flexibility. The relevance of a rate lock feature often depends on how much exposure you have to changes between application and settlement.

During periods of pricing volatility

Lenders can adjust fixed rates independently of cash rate decisions. Fixed-rate pricing is typically reviewed at the lender level and can change in response to broader market conditions, which means rates may shift while a loan application is still underway.

With longer settlement timelines

The longer the gap between approval and settlement, the more opportunity there is for repricing. Locking can reduce exposure when timelines are volatile or extended.

When borrowing capacity is tight

Borrowers close to their borrowing limits may prioritise assurance. Even small rate increases can change repayment outcomes, making a rate lock feature more appealing in these cases.

When waiting may be the better option

Choosing not to lock can make sense when flexibility is more valuable than certainty.

You may decide to wait if:

- You are still comparing lenders or loan structures.

- You expect rates to ease and want to retain flexibility.

- Your financial position may change before settlement.

If you choose to wait, it’s important to confirm how your lender applies settlement-day pricing so there are no surprises later.

Partial rate locks and split loan strategies

Some lenders offer ways to reduce exposure to rate changes without locking the entire loan.

A partial rate lock:

- Applies the lock to only part of your loan balance

- Is often used alongside a split loan structure

- Can reduce exposure to rate rises while preserving flexibility

A split loan strategy:

- Divides the loan into fixed and variable portions

- Allows the fixed portion to be locked while keeping features like extra repayments on the variable side

- Is commonly used by borrowers seeking balance rather than predictability alone

How a mortgage broker can help

According to the Deloitte and the Mortgage & Finance Association of Australia’s The Value of Mortgage and Finance Broking 2025 report, around 75% of new residential home loans in Australia are now arranged through mortgage brokers. This reflects how complex modern lending decisions have become, particularly when borrowers need to navigate lender-specific policies and pricing changes.

That complexity is especially relevant when deciding whether to lock an interest rate. A mortgage broker can help compare how different lenders apply rate lock features, including timing requirements, fees and what happens if circumstances change before settlement, allowing borrowers to make a more informed decision based on their situation rather than assumptions or headline rates.

Speak with a mortgage broker before you lock in

If you would like a clearer view of how interest rate locks may apply to your plans, connecting with a mortgage broker through OurTop10 can be a helpful next step. We connect borrowers with trusted experts in Sydney, Brisbane, Melbourne and across Australia, making it easier to access guidance that reflects real lender policies as they are applied in practice.

You may also explore our borrowing power calculator to see how different interest rates could affect your position, or check out our blog to stay informed on everything related to home loans.

FAQs

How do I lock interest rates?

Locking an interest rate is arranged during the home loan application process and needs to be requested upfront.

Here’s a step-by-step guide on how to lock interest rates:

- Choose a fixed-rate loan or fixed portion.

- Confirm the lender offers a rate lock feature.

- Request the rate lock when you submit your application.

- Pay the rate lock fee if required.

- Settle the fee within the lock period.

If you need support, OurTop10 can connect you with a trusted mortgage broker to guide you through the details and process.

When should I lock in my home loan rate?

Many borrowers consider locking their rate when they are concerned about pricing changing before settlement, especially if the settlement is still weeks away. It can also be useful during periods when lenders are actively repricing fixed rates. Whether it’s the right move depends on your timeline and how comfortable you are with short-term rate changes.

Can I lock in a rate before settlement?

Yes. A rate lock feature is designed to secure a fixed rate before settlement, rather than taking the rate available on the day your loan settles. Just keep in mind that rate locks usually apply for a set time, and delays to settlement can affect whether the locked rate still applies. Always check the expiry terms so you know where you stand if timelines change.

What is a split loan strategy?

A split loan divides your home loan into a fixed portion and a variable portion. This allows you to lock in a rate on part of your loan while keeping flexibility on the rest. It is often used by borrowers who want some stability without fixing their entire loan.

Are there fees for rate locks?

In most cases, yes. Lenders usually charge a fee to lock in a rate, either as a flat amount or a percentage of the loan. These fees are often non-refundable, so it’s worth understanding the cost and conditions before deciding to lock your rate.

“A rate lock is basically an insurance policy against your lender repricing before settlement. If you’re buying with a longer settlement or you’re close to your borrowing limit, it can remove a lot of stress — because you’re not crossing your fingers that the rate will still be there when the loan funds.”

– James Haywood, Approved Finance

James specialises in helping property investors accelerate their investment growth by utilizing cutting-edge technology to identify high-growth suburbs and optimize loan structures. Through the Property Surfer Program, clients can save on home loans, set up optimal property purchase structures, access top-tier market data, and benefit from automated loan repricing every three months. The services also focus on asset protection and risk minimization to ensure the best outcomes for clients.

Since 2017, James has been dedicated to enabling property investors to scale their portfolios and make data-driven investment decisions. By engaging with James, clients benefit from not only their expertise but also a network of top referral partners in financial planning, accounting, conveyancing, family law, and building inspections. Together, they aim to achieve greater growth and freedom in the property investment journey.