Introduction

The Australian mortgage market is competitive, with both traditional banks and online lenders offering a wide range of options. This ING Home Loan Review provides an objective look at ING’s home loan products, outlining their features, benefits, and limitations. ING is known for its digital-first approach and competitive interest rates, making it a popular choice for tech-savvy borrowers.

ING home loans may appeal to first-home buyers, investors, and refinancers seeking flexible options and low fees. However, as with all financial products, it is important to weigh the pros and cons before applying. This review explores ING bank home loans in detail to give readers a clear understanding of what they offer.

Key Features of ING Home Loans

ING offers a range of home loan products designed for different borrower needs. These loans generally allow a high loan-to-value ratio (LVR), although borrowing above 80% usually requires lenders mortgage insurance (LMI).

Borrowers can choose between variable and fixed interest rate options, with repayment types including principal and interest or interest-only for eligible applicants. ING also provides package options that combine home loans with everyday banking, offering potential fee savings.

Eligibility typically depends on meeting ING’s income, credit history, and property requirements. Online tools and calculators on the ING website allow applicants to estimate borrowing capacity before applying.

Benefits of ING Home Loans

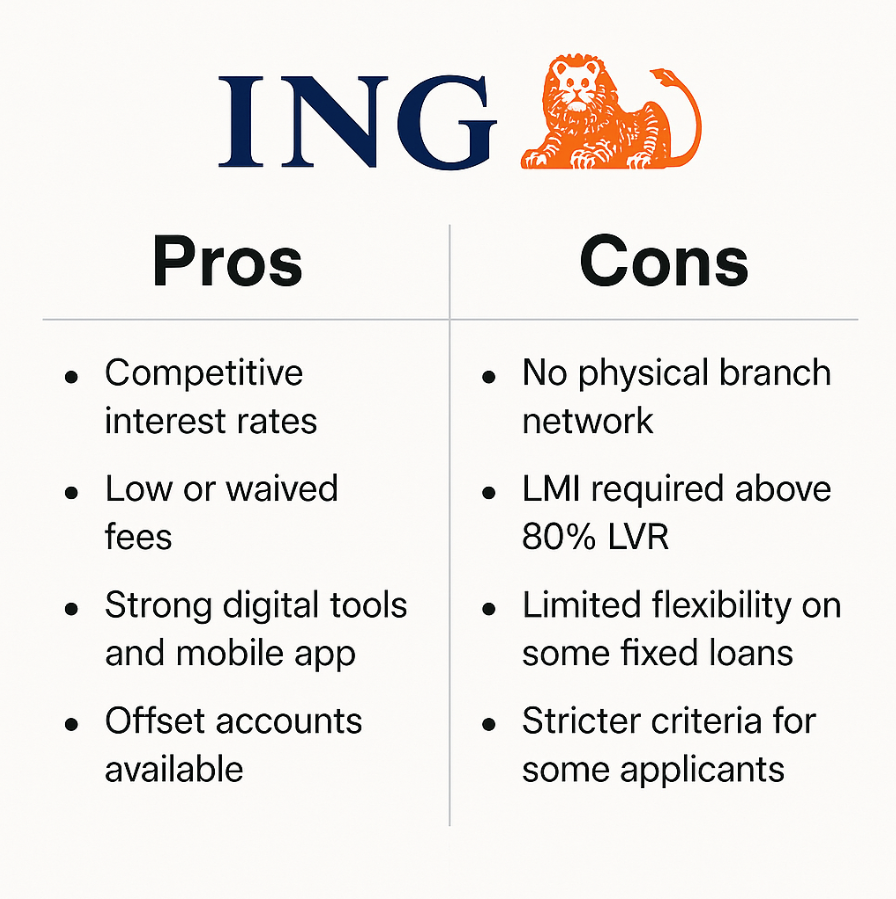

One of the biggest advantages of ING home loans is their competitive interest rates, which often compare well against larger banks. ING also stands out for low or waived fees on certain products, which can reduce upfront and ongoing costs.

Another benefit is the strong digital experience. ING’s mobile app and online portal allow customers to manage their loan easily, make additional repayments, and redraw funds with minimal hassle.

Flexibility is another strength, with offset accounts available on eligible variable loans, helping borrowers reduce interest over the life of the loan.

Drawbacks of ING Home Loans

While ING home loans offer many benefits, they may not suit everyone. Borrowers who prefer in-person service may find the digital-only model less convenient, as ING does not operate traditional branches.

In addition, high LVR loans will usually attract LMI, which can add to overall costs. Some applicants with complex financial circumstances, such as self-employed borrowers, may face stricter eligibility criteria compared to major banks.

Fixed-rate products may also come with restrictions on extra repayments or redraws, limiting flexibility for borrowers seeking faster debt reduction.

Comparison to Alternatives

Compared to the big four banks, ING home loans are often positioned as a lower-cost alternative, with streamlined digital processes and fewer fees. This appeals to borrowers comfortable managing their finances online.

When compared to other digital lenders, ING has the advantage of being an established brand with a strong reputation in Australia. However, newer fintech lenders may sometimes offer niche features, such as faster approval times or innovative repayment structures, that ING does not.

Overall, ING bank home loans compete strongly on interest rates and fees, while potentially lagging on in-person service and tailored loan structures.

Who Might Consider This Product?

ING home loans may be suitable for a wide range of borrowers, including first-home buyers, investors, and those refinancing to access better rates. First-home buyers with smaller deposits may find ING appealing if they qualify under government schemes or can manage LMI costs.

Investors may also benefit from interest-only options, while refinancers often look to ING for competitive rates and fee savings. However, borrowers seeking face-to-face service or highly customised loan products may find other lenders more suitable.

Application Process

The application process for ING home loans is primarily digital, with a strong emphasis on convenience and speed. Applicants can start online by providing personal details, income information, and property details.

Required documents generally include proof of income, identification, and details of existing financial commitments. ING offers a pre-approval process, giving borrowers an indication of their borrowing capacity before they commit to a purchase.

The digital application system also enables status tracking, helping applicants stay informed throughout the approval process. Talk to OurTop10 advisors to guide you through the ING application process and explore your refinancing or purchase options.

Conclusion

ING home loans offer a compelling mix of competitive rates, low fees, and a highly digital application experience. For borrowers comfortable with online banking, ING can be a cost-effective option that simplifies loan management.

However, drawbacks such as the lack of branches, LMI requirements for high LVR loans, and stricter eligibility for complex cases may make them less suitable for some borrowers. Overall, this ING Home Loan Review shows that ING home loans are best suited to digitally confident borrowers seeking straightforward and competitive mortgage options.

FAQs

- Does ING offer offset accounts on home loans?

Yes, offset accounts are available on eligible variable rate ING home loans, helping borrowers reduce interest payable. - What is the maximum LVR with ING home loans?

Borrowers may access loans up to 95% LVR, but anything above 80% generally requires lenders mortgage insurance (LMI). - Can self-employed applicants get an ING home loan?

Yes, but stricter documentation and assessment criteria may apply compared to PAYG applicants. - How do I apply for an ING home loan?

Applications are made online, requiring identification, proof of income, and details of existing debts. Pre-approval is also available. - Does ING have physical branches in Australia?

No, ING operates as a digital-only bank, so all services are delivered online or over the phone.