What You Should Know About Negative Gearing On Your Property

If you’re considering investing in a rental property, it’s essential to understand negative gearing and the long term financial implications it may have on you. In this comprehensive guide, we will examine the ins and outs of negative gearing, including what it is, how it operates, the tax considerations, pros and cons, prevalent risks, and strategies for mitigating these risks.

By the conclusion of this article, you will have a thorough comprehension of negative gearing and whether or not it is the optimal investment strategy for you. With the help of a mortgage broker from our Sydney and Melbourne listings, you can grasp an ever deeper insight to make the best decision for you.

What is negative and positive gearing?

Before delving into the complexities of negative gearing, let’s define it and contrast it with positive gearing. Borrowing money to invest in an asset, such as a rental property, is known as negative gearing.

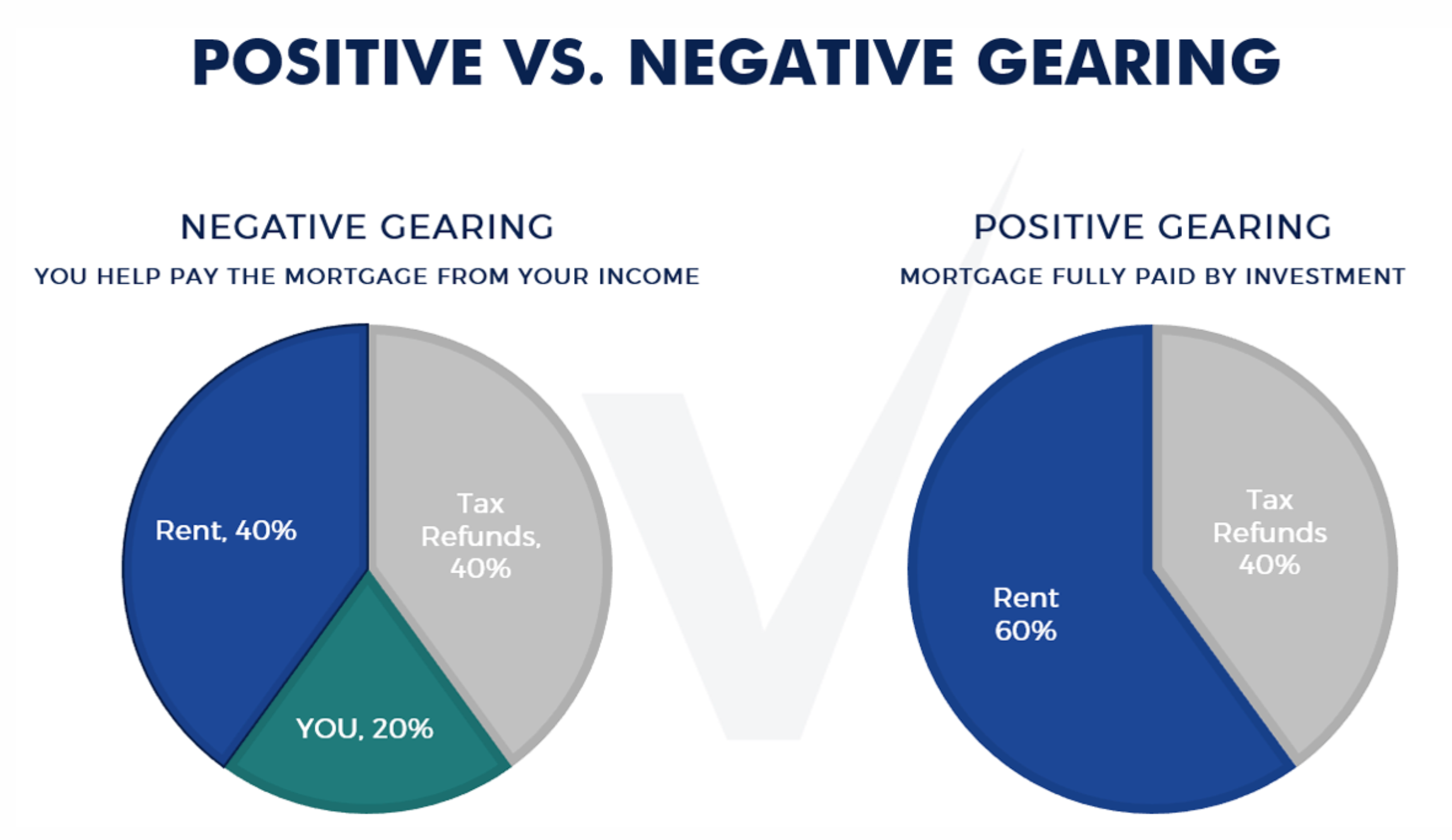

Positive gearing occurs when the investment property’s rental income exceeds its expenses, resulting in a surplus or positive cash flow. Negative gearing, on the other hand, occurs when rental income falls short of expenses, resulting in a deficit or negative cash flow.

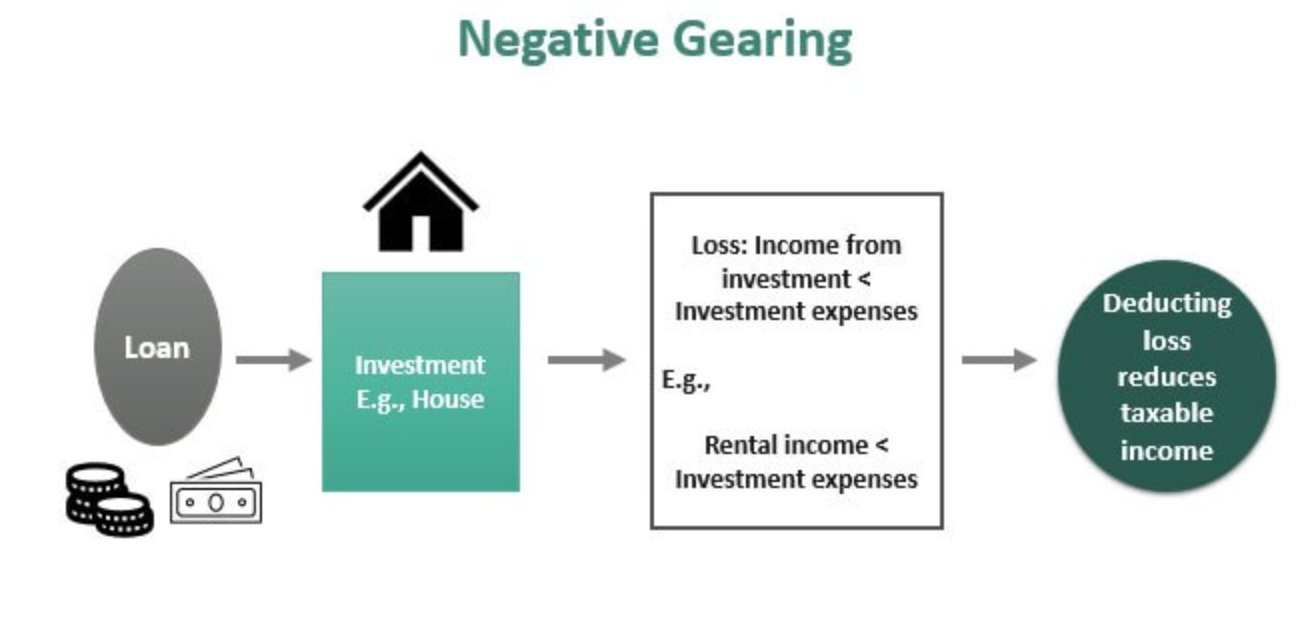

How does negative gearing work?

Think of negative gearing as owning a business, except for this business has been set up to lose money in the short term. You can claim the losses against your taxable income which then gets you a significant tax return (if set up correctly).

Negative gearing can occur when you borrowing money to invest in an asset, typically property or shares and using the income from the rental property from to fund the typical costs of ownership.

There are other ongoing costs such as maintenance, mortgage repayments, rental property management fees, insurance, and repairs that will also need to be covered.

If the rental income is insufficient to cover these costs, the investor may be able to mitigate the loss against their taxable income, thereby reducing the income tax liability.

This tax deduction should hopefully help to make up the shortfall in rental income and reduce the overall cost of property ownership.

Tax considerations with negative gearing

One of the most important and potentially advantageous aspects of negative gearing is the tax implications it can have on your financial situation now and in the future.

Despite the fact that the ability to offset losses against taxable income can provide some financial relief, it is essential to understand its limitations and potential risks moving forward.

That is why it is imperative that you seek out professional advice before taking steps that commit you to the process (such as signing a contract of sale).

Negative gearing-related tax laws and regulations can vary by state; therefore, it is essential to consult a qualified accountant or tax advisor to ensure compliance with the applicable tax laws.

It is also important to remember that you will owe capital gains tax on any profit you realise from the sale of the property. Once again you may have a tax deduction or deductions that your accountant can assist you to claim once the sale is completed so that you minimise your capital gains tax bill.

Pros of a negatively geared property

Despite the potential risks and complexities, negative gearing if a very popular strategy carried out by countless property investors across Australia. Negative gearing can provide property investors with many tax benefits as well as other advantages.

Let’s take a detailed look at a few benefits:

Possibility of capital appreciation: Although the property may generate negative revenues in the short term, the property may appreciate in value over time, providing the opportunity for future capital gains to be realised upon the sale of the property in the future.

The ability to offset losses against your taxable income can result in lower income tax payments, potentially reducing the investor’s overall tax burden.

Cons of a negatively geared property

In addition to the prospective benefits, negative gearing has some disadvantages. It is crucial to consider the following:

Negative gearing: This can result in a shortfall in rental income, requiring the investor to fund ongoing expenses out of pocket, which can put a strain on your household budgets .

Capital appreciation: This is a potential benefit of negative gearing, but it is not guaranteed, and relying solely on it as an investment strategy can be hazardous given the volatility of property prices.

Risks associated with altering market conditions: The property market is susceptible to a variety of factors, such as economic conditions, interest rates, and demand, which can have a negative impact on rental income and property value, thereby jeopardising the investment.

Interest rate fluctuations: If interest rates rise, the cost of financing for the investment property may increase, resulting in higher mortgage payments and a further reduction in revenue.

Variations in rental income: Rental income can fluctuate based on market demand, tenant turnover, and economic conditions, which can impact the property owner’s ability to cover expenses and generate positive cash flow.

Ownership of a property entails ongoing expenses, such as repairs, maintenance, and unexpected costs, which can build up and affect the investment’s profitability.

The property market is susceptible to value fluctuations, and a decline in property prices can impact the potential for capital gains upon the sale of a property.

Common risks associated with negative gearing

Although negative gearing may involve risks, investors can implement strategies to mitigate these risks. Here are some tips:

How to minimise the risks of negative gearing

Having adequate insurance coverage is imperative whether a property is negatively geared or not. Coverage such as landlord insurance and building insurance is usually a requirement by a lender that you are borrowing funds from.

However even if the property is unencumbered (no money owing) and is cash flow positive, we recommend that you have adequate insurance to help secure your investment property against unforeseen events, thereby reducing the financial risks associated with property ownership.

Careful selection of your investment property

Extensive investigation and due diligence is essential when choosing the ideal investment property. Location, potential for capital appreciation, rental demand, and the investment property’s condition are all important considerations.

Managing your income

Appropriate budgeting and financial management are essential to ensuring that you can cover the property’s ongoing expenses, even in the event of negative revenues when the property is negatively geared.

Having an emergency fund and keeping account of your income and expenditures can assist you in remaining financially prepared.

Is negative gearing right for you?

Negative gearing may be the optimal investment strategy for you, depending on your personal financial situation, risk tolerance, and investment objectives.

Before making investment decisions, it is essential to carefully weigh the potential benefits and risks, seek professional advice, and conduct extensive research and analysis of the property market before you dive in.

It is important to remember that major and regional cities are made up of multiple property markets so reading in the media about an average down turn or upturn may be misleading and inaccurate.

Negative gearing is a potentially complex investment strategy with potential benefits and hazards. It is essential to comprehend its operation, tax implications, pros and cons, and common associated risks.

By implementing strategies to minimise risks, managing your income meticulously, and protecting your investment, you can make an informed decision about whether negative gearing aligns with your financial objectives and risk tolerance.

Before making any investment decisions, remember to always seek professional advice from qualified experts, such as financial advisors and accountants.

As with any other form of investment, real estate investment entails inherent risks, and it is crucial to be well-informed and financially prepared.

Be sure to reach out to the mortgage brokers who are listed on OurTop10 as they have already been vetted and rated based on their awards and online reviews, that way you know that you are in good hands.

FAQs About Negative Gearing in Australia

Negative gearing occurs when the expenses of owning a rental property exceed the income it generates. This shortfall can often be claimed as a tax deduction, which is a strategy used by many Australian property investors.

In Australia, negative gearing allows investors to offset their rental property losses against their taxable income. This means if the costs of maintaining the property are higher than the rental income, the investor can deduct this loss from their overall income, potentially reducing their tax liability

The primary benefits of negative gearing include tax deductions, the potential for long-term capital gains, and the ability to diversify an investment portfolio. It can make property investment more attractive by improving cash flow through tax savings.

Yes, the risks include potential property value depreciation, ongoing negative cash flow, changes in tax laws, and economic downturns. It’s essential for investors to consider these risks and seek professional advice before committing to negative gearing.

Typically, higher-income earners benefit the most from negative gearing because they can offset significant tax liabilities. However, it can be advantageous for any investor looking to reduce taxable income and build long-term wealth through property investment.

While negative gearing can be beneficial, first-time investors should carefully assess their financial situation and risk tolerance. Consulting with a financial advisor or mortgage broker can help determine if this strategy aligns with their investment goals.

To determine if a property is negatively geared, subtract the annual rental income from the total annual expenses (including mortgage interest, maintenance, insurance, and other costs). If the result is a negative number, the property is negatively geared.

Yes, negative gearing can apply to residential, commercial, and industrial properties. However, the specific benefits and considerations may vary depending on the type of property and investment strategy.

Over the years, various governments have proposed changes to negative gearing laws, such as limiting tax deductions to new properties. It’s important to stay informed about current policies and potential changes that may impact your investment strategy

For professional advice, consider consulting with a qualified financial advisor, tax accountant, or mortgage broker. They can provide tailored guidance based on your financial situation and investment goals

TORI DUNLAP

Tori is a finance blogger and researcher at OurTop10.com.au, where she enjoys helping people navigate the world of finance and money. Through her insightful articles and comprehensive research, she empowers readers with valuable knowledge on budgeting, saving, investing, and retirement planning.

Tori’s approachable and empathetic style makes complex financial concepts relatable and easier to understand, She aims to foster a sense of community and leave a lasting, positive impact on her audience’s financial well-being.