Navigating the world of property valuations may seem daunting, but understanding the fundamentals of the process and how what you can do can greatly affect the property’s value can greatly benefit homeowners, buyers, and investors. Why is your property valuation so important, and how is it calculated?

In this article, I will delve into the various aspects of the topic to shed light on what is a property valuation. I will aim to shed light on its purpose, the factors that influence and affect the value, the different methods, and the difference between valuation and appraisal.

The aim is to equip you with the knowledge to make informed decisions, though further consultation with a mortgage broker or financial advisor is still recommended.

Short Summary

- Property valuation is the process of estimating a property’s market value based on its size, location, age and condition.

- Property valuations provide necessary information for fair prices, taxation, and legal requirements.

- Valuation services are available from specialised firms or licenced valuers to accurately assess residential, commercial, and industrial properties.

Understanding Property Valuation

Property valuation is an essential tool in the real estate market. It is the process of estimating a property’s market value by considering various factors such as its size, location, age, and condition. A qualified valuer, professional surveyor, or a real estate agent assesses these features and compares them to other properties within the vicinity to generate a detailed, legally binding report of a property’s fair market value. This report, with the property valuation calculated, can be used for various financial, legal, and tax purposes.

The property’s location plays a significant role in determining its value. Other factors influencing property valuation include economic and social trends, as well as the property market’s current state. Knowing these factors can help property owners make informed decisions when buying, selling, or refinancing properties.

The Purpose of Property Valuation

Property valuation serves a multitude of purposes. It helps in determining fair market prices for sellers, assessing good buys for buyers, and fulfilling tax and legal requirements. An accurate property valuation is indispensable for various financial, legal, and taxation objectives.

Obtaining a property valuation report from a qualified expert is crucial to avoid penalties from the Australian Taxation Office (ATO) if the valuation is deemed inadequate. It is essential to ensure that the valuation is accurate and reliable, as a miscalculated valuation can lead to financial or legal complications.

Factors Influencing Property Valuation

Several factors influence property valuation, including location, land size, age and condition of the property, the number of rooms and bathrooms, surrounding facilities, and home renovations. Economic factors and supply and demand in the real estate market also play a role in determining a property’s value.

Understanding these factors can help buyers and sellers make informed decisions when purchasing or disposing of a property. It can also guide property owners in making improvements and renovations that could positively impact the property’s value.

Types of Property Valuations

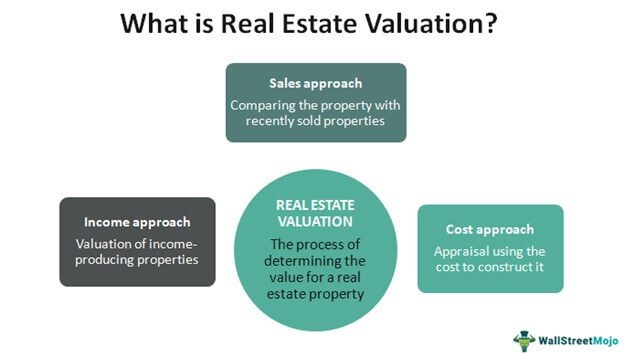

There are three customary methods used for property valuation: summation, direct comparison, and income capitalisation. Each method has its strengths and weaknesses, depending on the property type and market conditions. Understanding these methods can help property owners, buyers, and investors choose the most suitable valuation approach for their needs.

These methods take into account different aspects of the property and market dynamics, providing a comprehensive understanding of a property’s value. Let’s explore each method in detail.

Summation Method

The summation method is a widely used property valuation technique that calculates the value of a property by adding the land value and the depreciated value of improvements, such as buildings and other structures.

This method focuses on the cost of replacing or reproducing the property’s components and offers a more tangible perspective on its value.

Direct Comparison Method

The direct comparison method, also known as the comparative market analysis or sales comparison approach, determines the value of a property by comparing it to similar properties that have recently sold in the same area. It considers factors such as location, size, age, and condition of comparable properties to evaluate the subject property’s worth.

This method is widely used in residential property valuation, as it reflects the current estimated market sentiment and trends in the property’s market, providing an accurate estimated market value.

Income Capitalisation Method

The income capitalisation method estimates the property’s value based on its potential income-generating capacity. This approach is particularly useful for investment properties, as it calculates the net operating income and determines the capitalisation rate, which represents the anticipated rate of return on the investment property.

By considering the property’s income potential, this method provides an insight into the property’s long-term value and investment viability.

When to Obtain a Property Valuation

There are several situations when a property valuation is necessary. These include purchasing or selling a property, refinancing a mortgage, or obtaining insurance coverage. Additionally, property valuations are typically required for home loans, family or partnership settlements, capital gains tax calculations, and building insurance policies.

In some cases, the Australian Taxation Office (ATO) necessitates taxpayers to obtain a market valuation for taxation purposes, such as transfers of real estate or shares between related parties to calculate stamp duty liability. Ensuring that you obtain an accurate property valuation in these circumstances is crucial for legal compliance and financial stability.

Property Valuation Services and Professionals

Property valuation services can be obtained from specialised firms, local real estate agents, or licensed valuers. These professionals possess the required expertise to evaluate residential, commercial, and industrial properties accurately and efficiently. Valuation services encompass various types, such as market value reports, mortgages, automated valuation models (AVMs), and pre-sale and pre-purchase assessments.

Choosing the right professional for your property valuation needs is essential to ensure that the process is smooth, reliable, and accurate. It is advisable to consult multiple professionals and compare their services, expertise, and fees before making a decision.

Increasing Your Property’s Value

There are several ways to increase a property’s value, making it more appealing to potential buyers and investors. Enhancing curb appeal through landscaping, repainting the exterior, and replacing the front door can make a significant difference in the property’s overall appearance. Modernising finishes and appliances, such as updating countertops and installing new appliances, can also contribute to the property’s value.

Decluttering the space and applying a fresh coat of paint can make the property feel more spacious and inviting. Enhancing lighting and modernising landscaping by adding outdoor features can create an attractive outdoor living space that appeals to potential buyers.

Property Valuation vs. Property Appraisal

Although property valuation and property appraisal both aim to determine a property’s market value, they are fundamentally different in their approach and legal standing. Property valuation is a legally binding report provided by a qualified valuer, professional surveyor, or a real estate agent, and is based on an objective assessment of the property’s features and market conditions.

In contrast, a property appraisal is an informal estimate of the property’s value, typically provided by a real estate agent based on their market knowledge and experience. Valuation reports are generally more conservative and legally enforceable, as they do not factor in emotions, market knowledge, and other motivations that may influence the final sale price.

On the other hand, property appraisals can be influenced by market sentiment and the real estate agent’s expertise, making them more subjective and less legally binding.

Property Appraisal Basics

Property appraisals are based on local market analysis, similar properties, and current competition. They are useful for gauging market sentiment and providing a ballpark figure for the property’s potential sale value.

While not legally binding like property valuations, property appraisals can be a valuable tool in understanding the current market dynamics and trends.

Comparing Property Valuation and Appraisal

Property valuations and appraisals serve different purposes and cater to varying needs. A property valuation offers a more conservative and legally binding assessment of a property’s value, making it suitable for situations that require an official report, such as loans, legal disputes, and tax purposes.

On the other hand, a property appraisal provides a more flexible and subjective estimate of a property’s value, informed by the real estate agent’s market knowledge and experience. Appraisals are helpful in gauging market sentiment and can be used as a reference point for determining the property’s potential sale price or rental value.

Understanding the differences between property valuation and appraisal can help property owners, buyers, and investors make informed decisions based on their specific needs and circumstances.

Commercial and Industrial Property Valuations

Commercial and industrial property valuations require specialised knowledge and expertise, as they involve unique characteristics and market dynamics that differ from residential properties. Commercial properties are generally used for businesses that aim to generate profits, while industrial properties pertain to ventures related to the production of goods.

The income approach is a common method for valuing commercial properties, as it takes into account the potential income generated by the property and the associated expenses. Industrial property valuations, on the other hand, consider factors such as the type of industry, location, and size of the property.

Obtaining an accurate commercial or industrial property valuation is crucial for making sound business decisions and investments. If you need a property valuation, it’s essential to work with a trusted professional.

Capital Gains Tax and Property Valuation

Capital gains tax calculations often require property valuations to determine the accurate market value for tax purposes. The valuation is based on the market value of the property at the time of sale, taking into consideration factors such as location, condition, and comparable sales.

Accurate property valuations are essential for calculating the cost base and determining the potential tax obligations associated with the sale of a property. Ensuring that the property valuation is reliable and accurate can help property owners avoid financial or legal complications arising from miscalculated capital gains tax liabilities.

Summary

Understanding property valuation is crucial in making informed decisions in the real estate market. From residential to commercial and industrial properties, accurate valuations serve various purposes, such as determining fair market prices, assessing investments, and fulfilling tax and legal requirements. By grasping the differences between property valuation and appraisal and recognising the factors influencing property value, property owners, buyers, and investors can navigate the world of real estate with confidence and knowledge.

Frequently Asked Questions

What is the purpose of a property valuation?

Property valuation provides an objective and reliable measure of what a property is worth. This valuable information is essential to understand the market value of a house, apartment or other type of property. It can be used for buying, selling and refinancing decisions.

It’s completed by a valuer who will inspect the property, take notes, photograph building details and layout, and complete a valuation report.

What is property valuation Australia?

Property valuation Australia is a professional service to identify the estimated market value of a property. A licensed and experienced valuer performs an in-depth investigation of the property and its features before arriving at the current market price.

With a precise valuation report, it provides clarity on the true value of the asset for buyers, sellers, and financiers.

What is the difference between a valuation and an appraisal?

In summary, while an appraisal involves assessing something or someone, a valuation is an official process to assign a legally defensible monetary value to an asset at a specified date. The valuation must be undertaken by a qualified, professional valuer in order to ensure the accuracy of the results.

What is the difference between property valuation and market value?

Property appraisal is the process of determining an estimated market value of a real estate property, whereas market value is the actual sale price of a property. Property appraisal helps determine the fair value of a property, while market value reflects how much buyers are willing to pay for the property.

How is a house valued?

Property valuation is an important process that helps determine the market value of a property. To assess a property’s value, a valuer inspects the premises and considers factors such as condition, location, and amenities before submitting a valuation report.

This provides insight into what a home is worth in the current market.

FAQs for What is Property Valuation

Property valuation is the process of determining the current market value of a property based on various factors such as location, condition, and recent sales of similar properties in the area.

Property valuation is crucial for various reasons, including buying or selling a property, refinancing a mortgage, determining property taxes, and making informed investment decisions.

A property valuation is conducted by a professional valuer who assesses the property’s condition, location, size, and comparable sales in the area. They may also consider current market trends and economic factors.

Key factors include location, property size and layout, condition of the property, recent sales of similar properties, local market conditions, and any unique features or upgrades.

The valuation process typically takes a few days to a week, depending on the property’s complexity and the valuer’s schedule.

In many contexts, property valuation and appraisal are used interchangeably. However, an appraisal is often a more detailed evaluation conducted for lending purposes, while valuation can be a general market assessment.

It’s advisable to get your property valued when significant changes occur, such as market fluctuations, renovations, or before major financial decisions like selling or refinancing.

Yes, making improvements such as renovating key areas (kitchen, bathroom), enhancing curb appeal, and addressing any structural issues can increase your property’s value.

A property valuation determines the maximum amount a lender will loan you. A higher valuation can increase your borrowing capacity, while a lower valuation might limit it.

AVMs are computer-generated property valuations that use algorithms and data from public records, recent sales, and other factors to estimate a property’s value quickly.

Yes, professional property valuations typically involve a fee, which can vary based on the property’s size, type, and location. Some lenders may cover this cost as part of the loan process.

If you believe a valuation is inaccurate, you can provide additional information or recent comparable sales to the valuer and request a reassessment. It’s also possible to seek a second opinion from another valuer.