As financial experts and mortgage brokers, we have come across many home loan products that are designed to cater to the unique needs of home buyers.

One such product that has gained popularity in recent years is the split rate home loan.

In this article, we will provide a comprehensive guide on split loans, outlining what they are, how they work, the benefits, potential drawbacks, and who they are suitable for.

What is a split rate home loan?

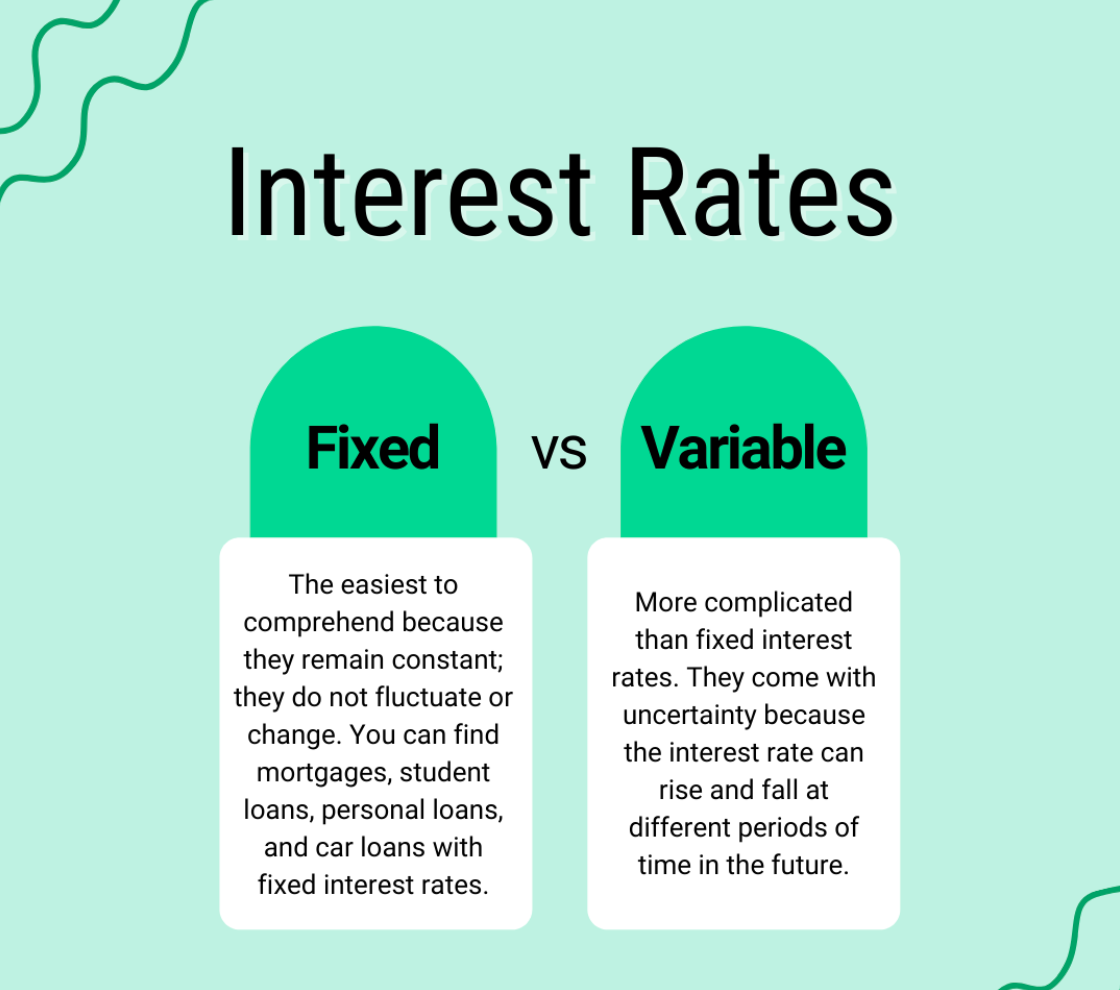

A split rate home loan is a type of home loan that combines both fixed and variable interest rates.

With this type of loan, you have the flexibility of dividing your home loan into two, with one portion having a fixed rate, while the other portion has a variable interest rate.

How do split rate home loans work?

Split rate home loans work by dividing your home loan into two portions, with one portion having a fixed interest rate and the other portion having a variable interest rate.

The fixed portion is usually set for a predetermined period, typically between 1-5 years, during which the interest rate remains fixed. After that period, the fixed portion reverts to the variable interest rate.

How much can you fix?

The amount you can fix on a split rate home loan varies depending on the lender and the loan product. In most cases, lenders allow you to fix between 20-80% of your home loan.

However, some lenders may allow you to fix up to 95% of your home loan.

What loans can be split?

Most home loan products can be split into fixed and variable portions. However, some lenders may have restrictions on the loan products that can be split.

Always check with your lender to ensure that the loan product you are interested in is eligible for a split rate home loan.

Benefits of split home loans

Split rate home loans offer several benefits to home buyers. Here are some of the benefits of split home loans:

Certainty of a fixed rate

One of the primary benefits of a split rate home loan is that you have the certainty of a fixed interest rate for a predetermined period.

This means that you can budget for your home loan repayments with certainty without worrying about fluctuations in interest rates.

Benefiting from falling interest rates

Another benefit of a split rate home loan is that you can benefit from falling interest rates.

If the variable interest rate portion of your loan decreases, your overall interest rate will reduce, reducing your home loan repayments.

Minimise the impact of interest rate hikes

A split rate home loan also helps to minimise the impact of interest rate hikes. If the variable interest rate portion of your loan increases, the fixed interest rate portion remains unchanged, reducing the overall impact of the interest rate hike on your home loan repayments.

Flexibility of a variable home loan

A split rate home loan provides the flexibility of a variable rate home loan. This means that you can make additional repayments on the variable interest rate portion of your loan without incurring any penalties.

Adjustable to your preferences

Split rate home loans are adjustable to your preferences. You can choose the percentage of your loan that you want to fix and the duration of the fixed rate period, giving you control over your home loan repayments.

Potential drawbacks of split home loans

While fixed and variable rate home loans offer several benefits, they also have potential drawbacks that you need to consider before taking out a split rate home loan. Here are some of the potential drawbacks of split home loans:

Higher interest rates

Fixed and variable home loans may have higher interest rates compared to standard variable rate home loans. This is because you are paying a premium for the certainty of a fixed interest rate.

Break fees

If you decide to break the fixed rate portion of your loan before the end of the fixed rate period, you may incur break fees.

These fees can be significant, and you need to factor them in when considering a split rate home loan.

The fees can depend on how long is left on the fixed rate component of your home loan balance.

Complex loan structure

Fixed and variable rate loans have a more complex structure than a traditional fixed rate or variable loan, which can be confusing for some borrowers. You need to fully understand the loan structure before taking out a split rate home loan.

Who is a split home loan suitable for?

Split home loans are suitable for borrowers who want the certainty of a fixed interest rate but also want the flexibility of a variable rate home loan.

They are also suitable for borrowers who want to minimise the impact of interest rate hikes and benefit from falling interest rates.

However, split home loans may not be suitable for borrowers who are looking for a simple loan structure and lower interest rates.

If you are unsure whether a split rate home loan is suitable for you, speak to a financial expert who can provide you with tailored advice.

In conclusion, split rate home loans are a popular home loan product that provides borrowers with the best of both worlds: the certainty of a fixed interest rate and the flexibility of a variable rate home loan.

If you are considering a split rate home loan, consider the benefits, potential drawbacks, and whether it is suitable for your needs.

Remember to always seek the professional advice of a mortgage broker so you make sure that you are going down the correct path.

You should definitely do this before taking out any home loan product.

If you are interested in taking out a split rate home loan, speak to a financial expert from OurTop10.com who can provide you with tailored advice on the best loan product for your needs.

TORI DUNLAP

Tori is a finance blogger and researcher at OurTop10.com.au, where she enjoys helping people navigate the world of finance and money. Through her insightful articles and comprehensive research, she empowers readers with valuable knowledge on budgeting, saving, investing, and retirement planning.

Tori’s approachable and empathetic style makes complex financial concepts relatable and easier to understand, She aims to foster a sense of community and leave a lasting, positive impact on her audience’s financial well-being.